Expertise

Solutions and platforms

Reduce costs, reduce risks and improve service quality

The evidence is clear: applications are increasingly complex (networks and multiple technologies), it is difficult to identify the root cause of problems and mean time-to-resolution (impact on the bottom line) is increasing and it is difficult to gain a complete end-to-end view of application performance.

In addition, there is no real insight into the end-user experience, especially when the application crosses multiple platforms.

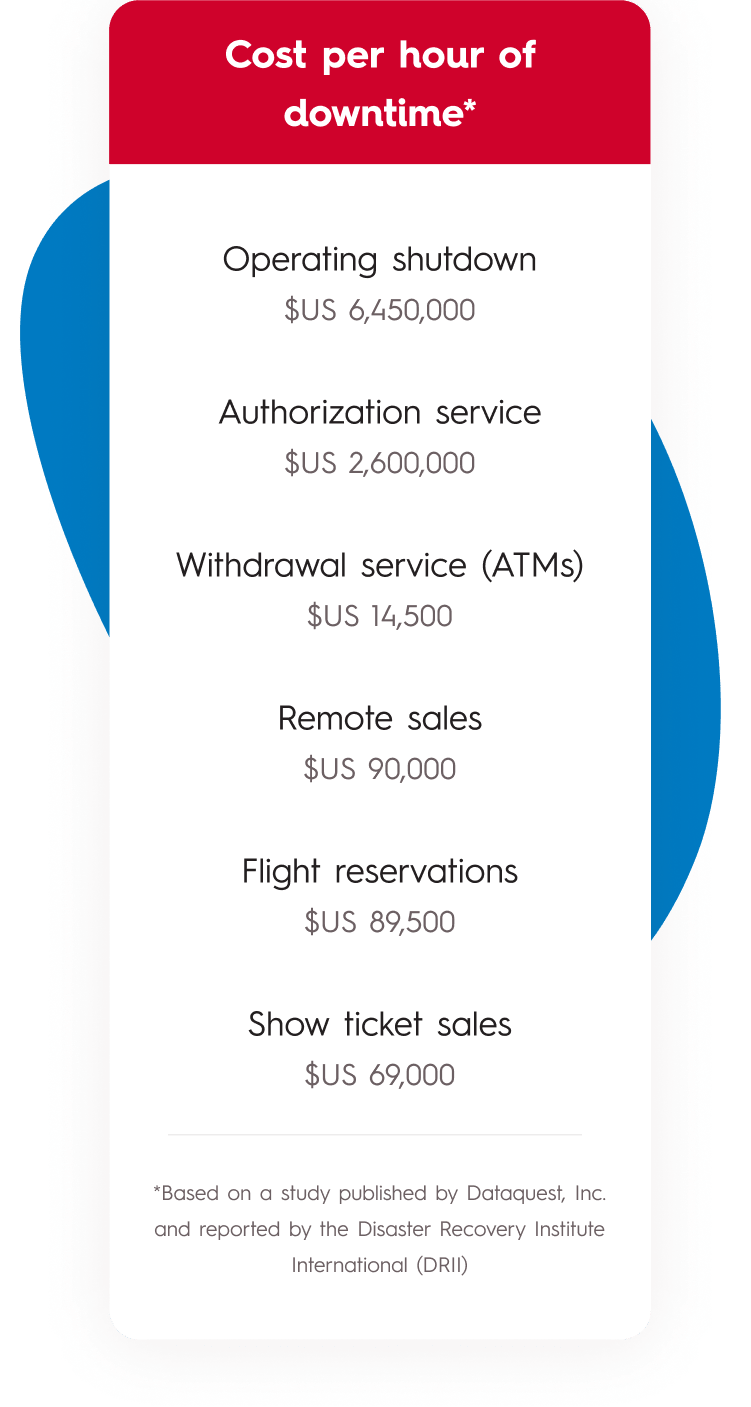

Poor application performance leads to a loss in staff productivity and customer dissatisfaction, as well as harming reputation and revenue losses.

Scale of error correction costs : US$ 1 during unit tests / US$ 10 upon validation / US$ 100 once in production

Our experts support you in your tests and development solutions

Test an isolated component, or all or part of the payment chain. Monitor real-time or batch applications Develop an embedded application or a customized solution implementing security modules. Developing a secure payment gateway. Outsource fuel card technical management.

Galitt’s Platforms team consists of 90 specialised engineers and technicians, offering a versatile and expert blueprint for dedicated turnkey or specific, local or SaaS, solutions along the entire payment value chain.

We also propose automated debugging tools for functional acceptance and load testing, regression testing and payment application certification.

Lastly, we provide relays throughout the world with a network of value-added resellers and Sopra Steria Group offices.

Testing

In order to guarantee systems integrity and reduce costs and risks and improve service quality, Galitt tests all components within the payment systems value chain, based on an automated testing process and tools certified by the major international schemes including Visa, Mastercard, American Express, EMVCo®, Discover, Nexo, UnionPay and GlobalPlatform®. Galitt has been publishing testing solutions for the card and payment market for more than 30 years and is a world leader servicing over 200 clients in 45 countries around the world. Galitt is also recognized for test automation and industrialization. We are particularly renowned for implementing test strategies and industrialization and also for setting up project management assistance strategies for mutualized issuer payment systems, including designing the reference acceptance target under a multi-distributor approach. Thanks to our card & payment testing software suite we are able to perform multiple tests as a publisher:

- Card and mobile testing

- Card personalization validation

- Terminal testing

- Testing transaction terminals, acquiring servers, issuers, networks, etc.

- Load tests

- File processing chain reception

Testing is one of the most important parts of quality control

- Detecting defects and errors: software testing is used to discover defects and errors made during the development phases.

- Increasing product quality: product quality can be improved considerably by reducing the number of defects and errors.

- Reducing maintenance costs: higher quality reduces software maintenance and increases profitability.

- Ensuring compliance with requirements: software testing verifies that requirements are implemented correctly

Testing and monitoring ensures customer satisfaction with the product and therefore customer loyalty.

The advantages of using testing tools are :

Reduction of repetitive work / reuse: regression tests, using the same test data and based on the same test procedures, can be easily performed using testing tools. Repetitive checks can be done automatically and reliably. The testing tools can be used as many times as necessary. Greater consistency and repeatability: testing tools reproduce exactly what needs to be done, making results consistent and replicable. Increased testing capabilities: testing tools allow you to perform tests that cannot be performed manually, such as boundary tests, load tests, etc. Objective assessment: using testing tools, subjective omissions or preconceived notions are removed. As a result, the assessment is completely replicable and carried out in a consistent manner. Ease of access to test information: test results and information provided by testing tools are more complete, detailed and meaningful. Results can be easily shared between testers, developers and integrators.

Application supervision

Through our application supervision solution, we measure service quality among transactional payment systems, in particular the availability of the system. This active application supervision offer, based on KaNest® simulators, sends requests to the monitored system according to a predefined schedule to detect failures and generate alerts. This offer is available in SaaS mode, hosted and operated in Galitt’s data centers.

Galitt’s application supervision enables :

- System/service functioning monitoring

- Determining the availability of the services rendered by testing the applications hosted by servers. For example, a payment authorization request acquisition service may have system and network supervision approving authorization, while merchant terminals get no response to their requests.

Fuel cards

Galitt offers Catti™, a modular, multi-channel and customizable solution and service for end-to-end processing (issuance, acceptance, billing) of fuel cards and private fleet cards, as well as customer relationship management (loyalty, customer benefits, management).

The Catti(TM) fuel card facilitates purchases by speeding up purchases at stations, managing advances and expense reports, managing the purchase of fuel and goods and services at stations, securing transactions by combating fraud and improving monitoring, controlling fuel expenses and their administrative management by regulating the use of cards and facilitating invoicing, VAT recovery, and access to business and cardholder activity information.

It is a flexible, scalable and customizable solution for end-to-end processing of fuel cards and private fleet cards, in all types of environment and for all types of players, whether they are independent station managers or networks, fuel payment card issuers or players in the retail sector, to enable issuing, acceptance and invoicing management.

Catti™ Customer Relationship Management is a solution adapted to all types of business to cover various needs including marketing, campaign management, segmentation, analysis and communication related to loyalty programs.

The solution harnesses the power of marketing to develop customer bases and prospective clients, and also benefit from efficient know-your-client dashboards.

The Catti™ solution is a turnkey, high-quality service in SaaS mode.

G-gateway™

Get rid of integration difficulties with banks and schemes

Gateways allow merchants, e-merchants and their service providers who do not have the technical and protocol expertise in payment to free themselves from integration difficulties with banks and schemes and to focus on business issues.

Gateways also allow banks to extend their payment services to PSPs and merchants, for example in new countries.

It can be clearly observed that each country has specific protocols and payment solutions are increasingly digitized, which leads to an increasingly complex ecosystem, particularly for fraud detection, security, tokenization, 3D Secure V2, etc.

There is therefore a strong desire to unify the payment system, to enable interoperability between acceptors, acquirers and issuers, liberated from the complexity of protocol conversions and concentrating on business functions: conversion tasks delegated to an expert.

This unified solution will also enable a unified acceptance solution over the entire payment acceptance chain without acquirer constraints, in order to guarantee compliance in terms of security: PCI DSS compliance relying on an expert and controlling maintenance: technical complexity delegated to an expert in the field, maintenance outsourcing allowing cost control and a service guarantee.

Gateways will make it possible to manage all types of transactions so that each customer can follow the payment path adapted to their needs, streamline diverse protocol adaptations between entities in the acceptance, acquisition and transmission domains that need to communicate and carry out transaction routing in a reliable and secure manner according to predefined rules.

Galitt has developed G-gateway™

Galitt has developed G-gateway™ to simplify exchanges between systems, as the growth in payments and the multiplicity of systems has made exchange protocols more complex :

- Galitt offers a service with solution hosting, with the option to integrate the solution into the client’s production infrastructure if possible.

- The G-gateway™ solution is scalable, regardless of the payment provider and over a wide range of protocols. It can be adapted to banking or private clients’ needs.

- It guarantees transaction quality, converts banking and private transactions to acquirer or issuer format, routes card transactions to acquirers and issuers and manages payment processes.

Embedded developments, payment and electronic banking, cryptography

Galitt develops embedded applications for the payment industry, on all types of terminals including card payment terminals, mobile phones and automatic devices. Galitt also offers solutions implementing cryptographic security applications or modules, including key management, authenticity control, encryption and tokenization, based on security modules available in the market such as IBM 47xx or Utimaco. Galitt is a qualified security assessor (QSA) company and supports its clients throughout all of the phases required to achieve PCI DSS standards compliance.

Galitt is officially recognized by Ingenico as a development partner and can therefore develop, sign, maintain and upgrade applications for Ingenico terminals.

Testing

In order to guarantee systems integrity and reduce costs and risks and improve service quality, Galitt tests all components within the payment systems value chain, based on an automated testing process and tools certified by the major international schemes including Visa, Mastercard, American Express, EMVCo®, Discover, Nexo, UnionPay and GlobalPlatform®. Galitt has been publishing testing solutions for the card and payment market for more than 30 years and is a world leader servicing over 200 clients in 45 countries around the world. Galitt is also recognized for test automation and industrialization. We are particularly renowned for implementing test strategies and industrialization and also for setting up project management assistance strategies for mutualized issuer payment systems, including designing the reference acceptance target under a multi-distributor approach . Thanks to our card & payment testing software suite we are able to perform multiple tests as a publisher:

- Card and mobile testing

- Card personalization validation

- Terminal testing

- Testing transaction terminals, acquiring servers, issuers, networks, etc.

- Load tests

- File processing chain reception

Application supervision

Through our application supervision solution, we measure service quality among transactional payment systems, in particular the availability of the system. This active application supervision offer, based on KaNest® simulators, sends requests to the monitored system according to a predefined schedule to detect failures and generate alerts. This offer is available in SaaS mode, hosted and operated in Galitt’s data centers.

Fuel cards

Galitt offers Catti™, a modular, multi-channel and customizable solution and service for end-to-end processing (issuance, acceptance, billing) of fuel cards and private fleet cards, as well as customer relationship management (loyalty, customer benefits, management).

The Catti(TM) fuel card facilitates purchases by speeding up purchases at stations, managing advances and expense reports, managing the purchase of fuel and goods and services at stations, securing transactions by combating fraud and improving monitoring, controlling fuel expenses and their administrative management by regulating the use of cards and facilitating invoicing, VAT recovery, and access to business and cardholder activity information.

It is a flexible, scalable and customizable solution for end-to-end processing of fuel cards and private fleet cards, in all types of environment and for all types of players, whether they are independent station managers or networks, fuel payment card issuers or players in the retail sector, to enable issuing, acceptance and invoicing management.

Catti™ Customer Relationship Management is a solution adapted to all types of business to cover various needs including marketing, campaign management, segmentation, analysis and communication related to loyalty programs.

The solution harnesses the power of marketing to develop customer bases and prospective clients, and also benefit from efficient know-your-client dashboards.

The Catti™ solution is a turnkey, high-quality service in SaaS mode.

G-gateway™

Galitt has developed G-gateway™ to simplify exchanges between systems, as the growth in payments and the multiplicity of systems has made exchange protocols more complex. The gateway enables the management of all types of transactions so that each customer can follow the payment path adapted to their needs. It also simplifies diverse protocol adaptations between entities in acceptance, acquisition or transmission fields that need to communicate and perform transactional routing in a reliable and secure manner according to predefined rules. Galitt offers a service with solution hosting, with the option to integrate the solution into the client’s production infrastructure if possible. The G-gateway™ solution is scalable, regardless of the payment provider and over a wide range of protocols. It can be adapted to banking or private clients’ needs. It guarantees transaction quality, converts banking and private transactions to acquirer or issuer format, routes card transactions to acquirers and issuers and manages payment processes.

Embedded developments, payment and electronic banking, cryptography

Galitt develops embedded applications for the payment industry, on all types of terminals including card payment terminals, mobile phones and automatic devices. Galitt also offers solutions implementing cryptographic security applications or modules, including key management, authenticity control, encryption and tokenization, based on security modules available in the market such as IBM 47xx or Utimaco. Galitt is a qualified security assessor (QSA) company and supports its clients throughout all of the phases required to achieve PCI DSS standards compliance.

Do you have questions ? Contact us !

Vincent Mesnier

Executive Vice President

Galitt – Platforms

Vincent.mesnier@galitt.com

+33 1 77 70 28 49

+33 6 63 64 32 23