In-vehicle payment: Tomorrow you will not get out of your vehicle to pay.

In a context where technological advances are opening up new possibilities, players in the payment world can look into solutions that were not previously imagined. For payment, these technological advances have resulted in the appearance of new concepts made possible by the multiplication of APIs developed in the field. Among these concepts, in-vehicle payment systems are emerging, with the aim of offering payment solutions directly integrated into vehicle navigation systems.

A favorable technological context

Today’s cars can indeed be considered as connected objects, although more cumbersome than a connected watch or bracelet. Car manufacturers have clearly understood the importance of integrating more technologies into their vehicles, influenced by the success of innovative players like Tesla. In the past, you used to need a car radio and a GPS: today everything is integrated directly into the car’s navigation system, echoing the evolution of the smartphone, which now combines numerous functionalities.

Payment within vehicles is in fact expected to increase due to several factors, related to the technologies available within the vehicle :

- Voice technologies, which have notably enabled Alexa to break into the automotive industry.

Smart wallets: more and more manufacturers are considering creating a wallet in their vehicles to enable payment transactions via the cloud.

The blockchain: some players have indeed chosen to develop crypto-currencies that can be used privately within the vehicle to enable purchases.

Concrete applications of in-vehicle payment

Several major players in the automotive world are therefore beginning to offer concrete payment applications within the vehicle, in collaboration with various PSPs. In 2019, FCA, Hyundai and Jaguar Land Rover have proposed on-board payment systems that allow the driver to:

- to navigate on the awning of their merchants, directly on the touch screen of the vehicle

- make purchases on these blinds, directly from the car

- benefit from discounts on relevant products and services, such as gasoline, parking and tolls in some countries

- arrange an appointment with his dealer if necessary

- …

This list of functionalities is not exhaustive as the possibilities are numerous once a connected system of this type is correctly installed. As stated above, the priority targets are still petrol, parking and tolls, the most relevant services to be paid from the vehicle.

The real challenge will be to regulate this in-vehicle payment so that it scrupulously respects security standards and allows users to make secure purchases from their vehicle. The opportunities are great for PSPs, who will have to find a way to form alliances with dealers, service stations and merchants to make the application of these new in-vehicle payment concepts a reality.

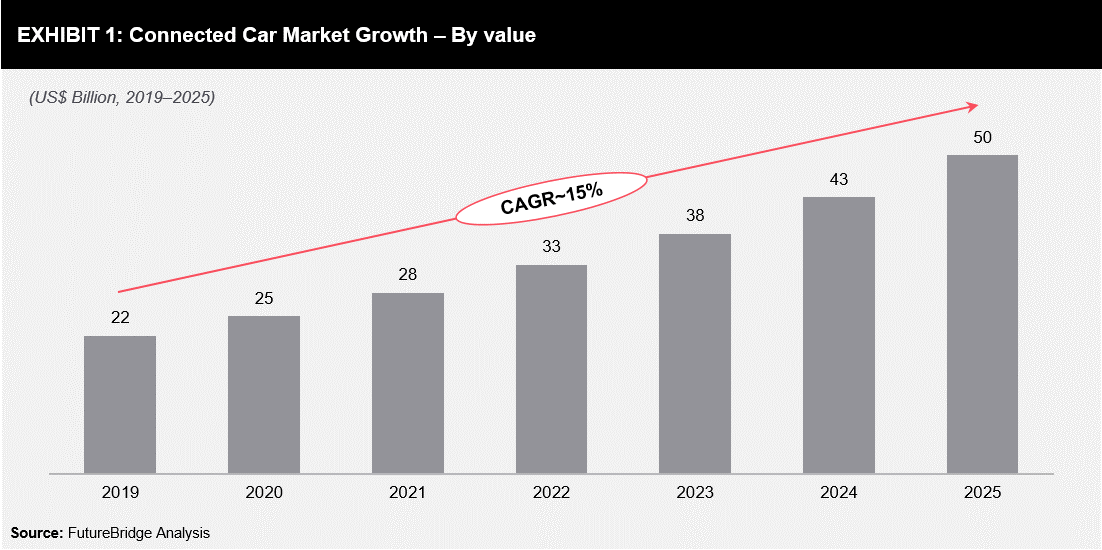

In any case, the players in the automotive sector seem to be invested in the subject, with the number of connected cars expected to double by 2025* as shown in the graph above. This type of integrated payment system will undoubtedly continue to develop to reach a sufficiently advanced security and technological stage to be able to establish itself as a reliable solution. In fact, a Gartner study predicted that embedded payments could represent $1 billion by 2023, compared to less than $100 million in 2020.

The most recent example is the partnership with ExxonMobil, to allow fuel payment from the vehicle, thanks to voice. A technology also exploited by the start-up company Cerence.