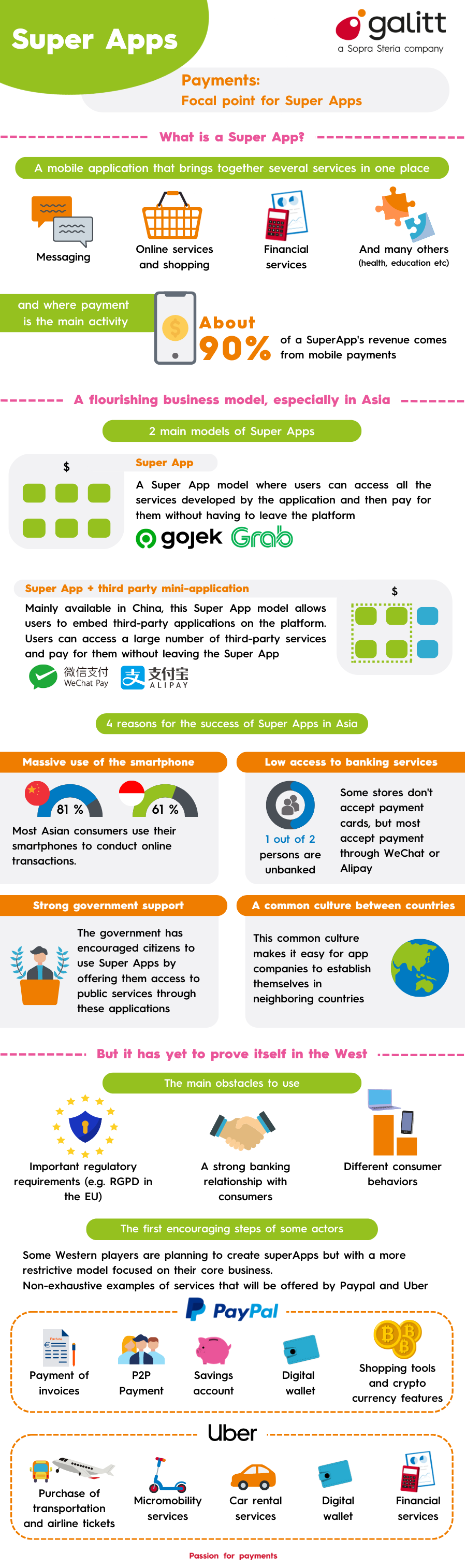

Directed payment – Blockchain and Payment: Synergies to be leveraged – Part 3

Blockchain: an answer to these expectations?

In this section we review the characteristics of blockchain to highlight the improvements it could bring to the current system. To do this, we go back to each of the flaws previously exposed and see the solution provided by blockchain.

A P2P network without intermediaries

The blockchain eliminates intermediaries. Users can thus exchange between them in a secure way. A consortium of users secures the network with a distributed consensus logic.

An Oracle (information source that allows to integrate data from the real world into smart contracts) adds new information to the blockchain.

Advantages for solution providers: A network without intermediaries means economic gains. Transaction time is reduced, and customer satisfaction is increased (e.g. no more pay in advance by customers)

Limitations: The enrolment should be done between the supplier, the company and the beneficiary (via a wallet for example) An oracle will enter all the verified information in the blockchain. They will be immutable, safe, and permanent.

Securing the holder / beneficiary

The blockchain allows to enter unforgeable digital identity data.

The identity solutions under development make the system near infallible, and uses the three principles of strong authentication:

- Possession: the private key is encrypted in the device’s hardware

- Knowledge: A secret code is requested from the user

- Biometrics: before signing a transaction, a video of the user is requested

Advantages: it drastically reduces fraud, and uses a zero knowledge proof – all information is encrypted and not transmitted, only conditions verification is performed (more privacy for the user)

Knowledge of the type of product or service purchased

Blockchain solutions allow to track a product throughout its life cycle (creation to delivery – by tracing the different transactions through the blockchain), so it allows to profile the product within the consumer basket and analyse the content (for example for food, the customer can make sure of the type of meat and its origin).

Advantages: it allows the customer to be more transparent vis a vis the product (date of production, production cost, production methods, …)

Traceability of transactions

All transactions are recorded and traceable in an unfalsifiable distributed register, in fact it is possible to know precisely where the payment has been performed in an immutable way.

Benefits: Knowledge of how funds are used

Programmable

The blockchain has created the notion of smart contracts, making the blockchain programmable, and making automatic transactions according to certain conditions.

Advantages: Create automatic conditions of use (without intermediate verification)

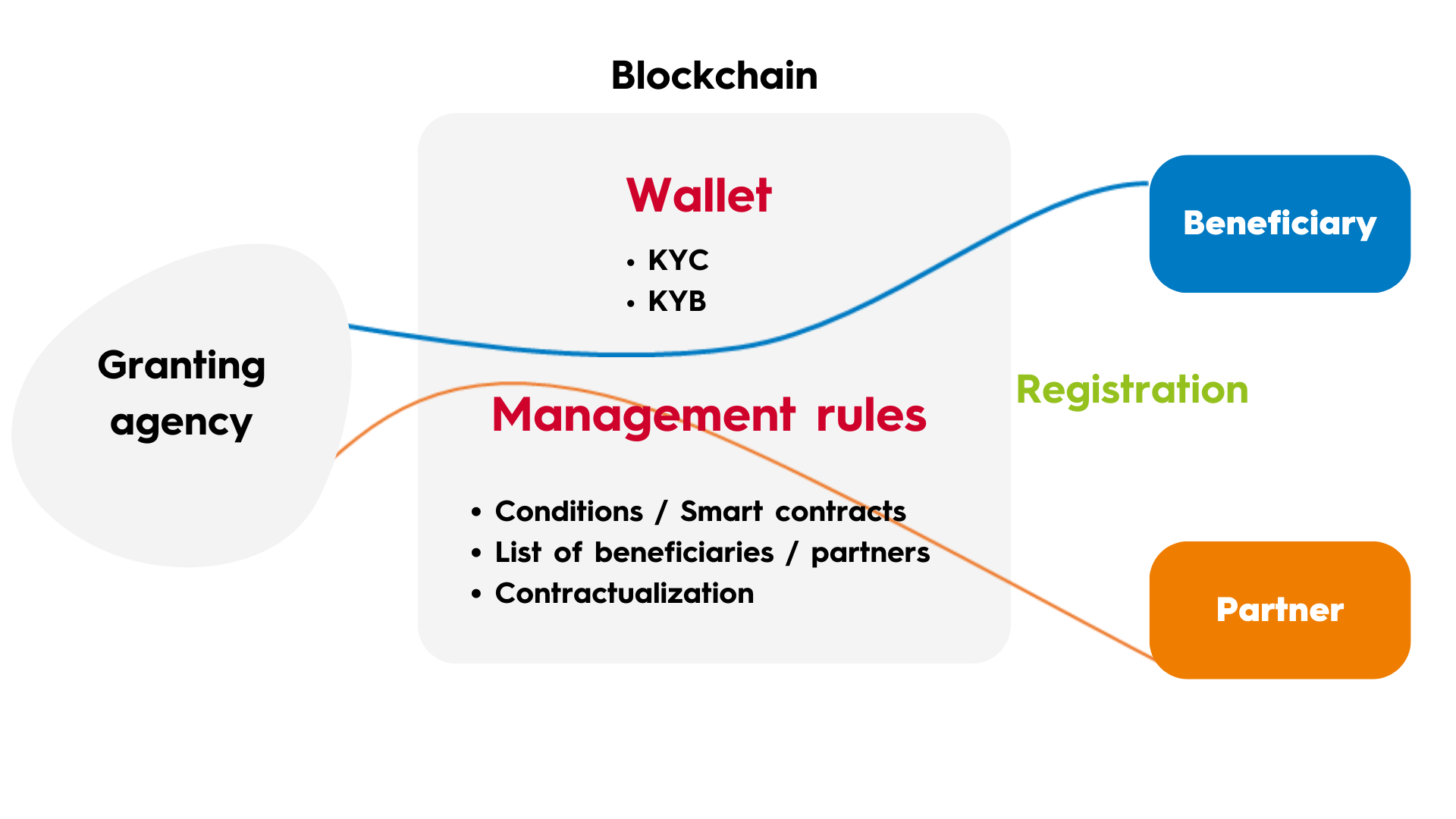

What infrastructure for a directed payment solution using Blockchain technology?

An idea of infrastructure

Directed payment involve three actors:

- Grantor: Person who issues the grant / releases the funds / public assistance

- Subsidized Individuals receiving assistance for a specific reason

- Network partner: merchant who can accept the grant

To make these three players interact via blockchain seamlessly, here’s an infrastructure idea.

Here are the different steps to set up such an infrastructure:

- Record partner / beneficiary information in the blockchain

- Create conditions for the use of smart contracts

- Spending rules

- Products scope

- Consumer domain limits

- Add a payment method between the three parties

- Request the money from the grantor to be scanned and returned to the recipient

- Design a way for the partner to be paid in fiat money

- Add a third-party payment method in case the grant does not fully fund the purchase

Nonobvious implementation

Multiple questions arise about possible choices on this type of payment solution directed in the blockchain ecosystem

Which blockchain?

It will be necessary to use a programmable blockchain to enter the grant use condition

A private or public blockchain?

Which oracle?

Who will enter the user/partner information into the blockchain, who will update it?

smart contracts creation?

How to write / make the conditions evolve? What auditability?

Product tracking?

How to ask merchants to enter their products on the blockchain to have knowledge and traceability of them.

A receptacle not yet defined

One strength of a blockchain solution would be to create a single solution that different grants would share.

For this purpose, different supports are possible

EU digital ID Wallet

As the government is aware of a lot of information about users, it could be in charge of creating the wallets.

Indeed, the state is a trusted actor, already possessing a lot of information:

- Identity

- Income

- Heritage

- home Information

- Driver’s license

- …

By digitizing all this information on the blockchain, it could facilitate the distribution of these grants.

The state could also appoint oracles to enter other information such as company rights, health insurance, … to make this support holistic.

Other ideas

Private actors could take this place, however the implementation in some cases of uses would be more complicated because a contact with an institution holding them would be necessary to enroll the beneficiary or partner

New challenges and use cases

The adoption of this technology would allow new use cases, which are not available today

- Prevent the client from paying in advance

The grantor would pay the partner directly

- Recurring payment

Depending on certain conditions, a settlement would be made automatically:

– Each day the employee works he/she receives a salary

– Payment per mission

– Insurance …

- Company subsidy / health insurance: benefits received directly from the partner without going through the platform / discount coupon / …

Many benefits are unknown to users. Thanks to a programmable payment instrument users would benefit from those advantages without necessarily knowing them. (at the time of payment the promotion is directly recognized)

- Transparency and product knowledge

product tracking to better decide its purchase

Examples: some products already in place

MoneyTrack

MoneyTrack is a secure digital payment platform in the healthcare sector that allows a health insurance company, a community, or an institution to pay money to individuals, who spend it conditionally within a network of authenticated healthcare professionals.

The platform relies on blockchain technology to share information, secure transactions, and track payment flows.

China: e-Yuan and stimulus check

China is using the digital yuan (central bank digital currency) to stimulate consumption in its pandemic-hit economy, and more e-CNY applications are expected to arrive in the future.

China is at the forefront of a global race to develop Central Bank Digital Currencies. Subsidizing in e-CNY can both encourage consumption and further promote the use of the electronic yuan.

Transactions using e-CNY totaled 87.6 billion yuan by the end of 2021, with 261 million individual e-wallets opened, according to the central bank.

“Previously, when the government provided subsidies, there might be some obstacles before the money reached the beneficiaries,” said G. Bin Zhao, senior economist at PwC China.

Zhao added that in the future, the government could use e-CNY for pension payments, tax subsidies and even infrastructure spending.

So China seems to be gradually adopting digital currencies in its policy.