Instant Payment – added value and impact on the Payment Value Chain

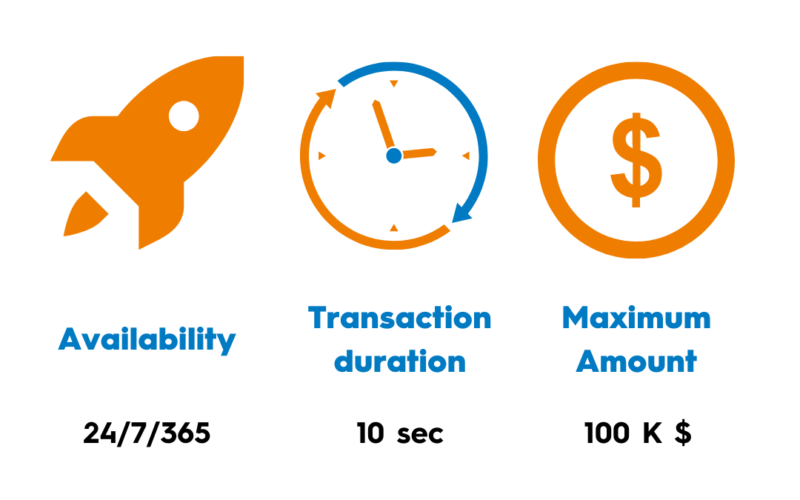

Instant Payment is a recent instant transfer service that is gradually making its appearance in the payment world. It aims to address several issues, including transactions between professionals, but also the integration of new payment initiators such as the Request to Pay discussed in the previous article. It is an important element of the European Payment Initiative (EPI) and will be a real payment standard in the future.

SOURCE: TrueLayer

The impact of Instant Payment on transactions

Instant Payment has the potential to boost transactions between customers and merchants or e-merchants due to its instantaneous nature. It should be remembered that the delays traditionally applied to traditional bank transfers are between 1 and 5 working days, delays that can be problematic for certain merchants or individuals who need funds quickly. This delay is justified by the controls carried out by the sending and receiving bank to secure the transaction during a SEPA transfer and to ensure the good solvency of the debtor. The banking information attached to the transaction is also checked.

Even if these delays do not seem excessive, they can become a real problem, especially in the business world. Some merchants cannot afford to wait for the funds they are owed, when they start their business or in the case of difficult financial periods. One of the objectives of the payment industry is to shorten these delays to make the confirmation and execution of all types of transactions more fluid.

One example is Air France, which offers an Instant Payment service on its website that allows them to reimburse their customers without delay. This instantaneous service reduces complaints and makes the airline’s entire refund system more fluid. The option is also available for paying for tickets. The high ceilings of the Instant Payment service avoid some payments being blocked by low credit card limits.

This method of payment does not only impact merchants: sales between individuals will also benefit. The payment is a delicate subject during this type of transaction and must be framed as well as possible in order not to put off the most skeptical/uncertain people. Being able to offer instant payment in this case is a real guarantee of safety for the seller who will receive the funds instantly, without worrying about a refusal of payment after the transaction. Unlike a payment by bank transfer or card, Instant Payment cannot be contested: the seller is guaranteed to receive the funds.

Instant Payment therefore allows :

- E-merchants and merchants to receive funds directly from a transaction via Instant Payment on their merchant site or in-store.

- The insurance companies will be able to reimburse the victims instantly, so that they can bounce back more quickly.

- Individuals can be reassured when they make transactions, particularly in the case of sales between individuals.

It can benefit all types of transactions, those of the professional world as well as the private world. Whether it’s a trader with low cash flow or a parent who needs to make an emergency transfer to their child. Instant Payment is applicable in all areas.

A competitor to the VISA and Mastercard networks?

As Instant Payment does not require bank cards, it is external to the networks of card distributors such as VISA and Mastercard. The question arises: can Instant Payment replace card payment?

The answer to this problem is still unclear, especially because of the youth of the instant payment service. Nevertheless, certain aspects are remarkable when comparing the two solutions. The advantage put forward by Instant Payment supporters is the elimination of an intermediary (VISA, Mastercard or CB), which will consequently eliminate the interbank commissions linked to bank card payments. These commissions (between 0.20% and 0.30% of the value of the purchase) represent a real source of expenses for merchants. The more customers a merchant collects via credit card, the higher the amount of commissions he will have to pay.

Even if Instant Payment will itself have an implementation cost, the potential savings could convince more than one merchant to adopt it. But let’s face it: the bank card has a place in the hearts of both merchants and consumers. It is the number one means of payment in many countries, accounting for nearly 33% of the number of transactions made by Europeans*. Even if some countries do not use it much, such as Germany, which remains attached to cash and bank transfers, it is undeniable that the bank card has become the leading means of payment.

Instant Payment should therefore not replace the current payment methods, but provide a new, more spontaneous option for those who need it. Subscribing to wallets/e-wallets such as Apple Pay or Paypal requires the use of a card anyway. So we are far from seeing the end of the bank card, but the prospects offered by instant payment and all the innovations in the payment sector are interesting. The options are multiplying, remaining in the logic of offering the consumer as many personalized options as possible so that he can find the one that suits him best. We will have to wait for more applications of Instant Payment to make real conclusions, as its application in the Request to Pay is highly anticipated by the payment industry.