Biometric cards: the example of Samsung

Expected for some time now, biometric cards are gradually making their appearance in the family of payment methods. These cards, which are based on the bearer’s own biological data, not only enhance the payment industry’s proposals, but also offer a glimpse into the future of card payment security.

Source – Biometric Update

The security promises of biometric cards

One of the most interesting things about the advent of biometric cards is the fact that they could eventually change the way card payments are secured both physically and online.

The use of bank cards varies greatly from country to country. In the United States, although the trend is beginning to change, the preferred bank card was the magnetic strip card that had to be swiped to make a payment. In France, the smart bank card has existed since its creation and is the absolute standard.

Without going into detail, the security of these two payment methods is not homogeneous. The chip card is in fact much more secure and less susceptible to fraud than the magnetic stripe card. And if we had to go even further, even chip cards can be compromised in the event of PIN theft or for the duration of a few contactless payments.

The goal and promise of biometric bank cards is to get closer and closer to the ultimate security when making payments. And there is no lack of arguments in their favor:

- Even if the card is stolen, the fraudster will not be able to make a contactless purchase, since the card will not have the same biometric data as the real cardholder.

- At the moment, biometrics seems to be the most relevant and secure way to identify the right cardholder. Even if the PIN code is already a bulwark, it cannot compete with biometric identification.

- Contactless payment limits could be ignored when paying with a biometric card. If the purchase exceeds the €50 threshold, the cardholder will have to use the biometric sensor to validate the purchase. Below 50€, the conditions of a classic contactless payment apply.

- Again, a wearer’s biometric data will always be more difficult to compromise than a 4-digit PIN code.

It is therefore easy to understand the relevance of this new means of making payments increasingly secure. In a recent article, we talked about the involvement of new players in the world of payment enabled by Open Banking: and these new players already offer biometric cards.

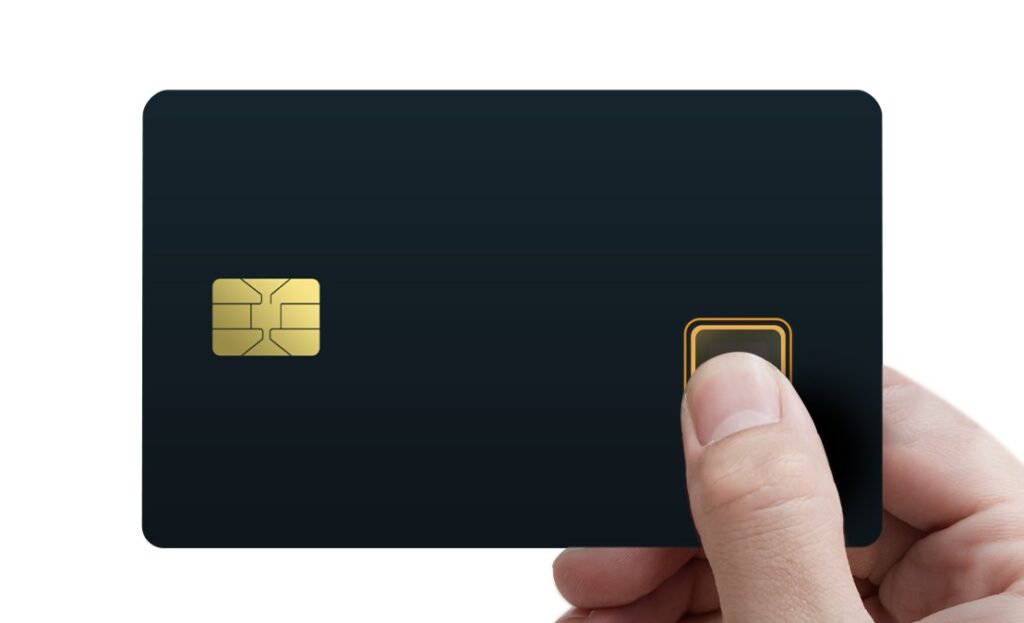

Samsung launches its biometric card

Where it seemed logical to see the traditional payment players offering biometric card services, it is even more interesting to see new ones taking an interest in the field.

In France, BNP Paribas and Société Générale have embarked on the biometric adventure and are offering biometric cards in line with their core business. What is more surprising is to see players from outside the payment industry taking an interest.

This is the case of the Korean company Samsung, which had already gotten involved in the world of payment with its Wallet proposal “Samsung Pay”. It was only very recently, on January 24, 2022, that Samsung presented its biometric card solution. Already certified by Mastercard, this card promises even more security thanks to a system that prevents the use of fake fingerprints to bypass the integrity of the card.

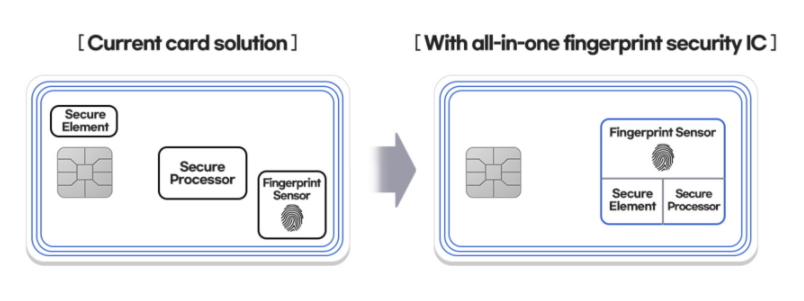

Another argument pushed by Samsung in favor of their card is the “all-in-one” aspect of the chip. The diagram below compares a classic biometric card on the left with the Samsung card on the right:

Source – Samsung

So we can see that Samsung has decided to centralize the important elements related to the authentication of the wearer on a single chip. The company hopes to eventually extend this functionality to corporate badges, student badges and any other sector that requires proper identification of the wearer.

It’s interesting to see the interest in payments from companies whose core business is completely different. We often talk about Open Banking and Samsung’s biometric card is another perfect example. It seemed unimaginable that this kind of company would be able to offer their own payment services 15 years ago: today, the largest companies in the world are interested and actively involved in the sector.