Younited points out the evolution of fractional payments in Europe

The European instant credit specialist, Younited, has just published the results of a study on fractional payments in Europe. The study highlights the expectations of European consumers, whether in terms of immediacy or longer repayment periods. In this respect, however, France is a special case in this market.

Facts

- Younited conducted a pan-European study across 5 countries: France, Germany, Spain, Portugal and Italy. 2,500 people evenly distributed in the 5 countries were asked about split payments.

- The study shows that consumer interest is growing, especially for staggered payments and instantaneous services, provided that protection rules are strengthened.

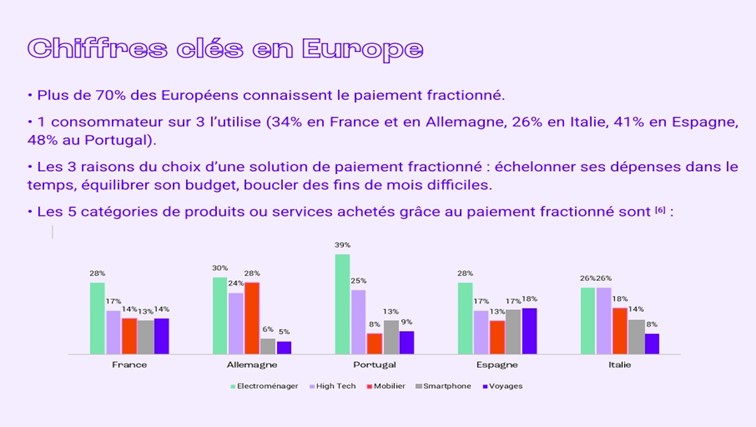

- Overall, more than 70% of Europeans are aware of split payments and 1 in 3 consumers use them. In detail, the rates vary from one country to another:

- 26% in Italy,

- 34% in France and Germany,

- 41% in Spain,

- 48% in Portugal.

- Users cite three factors of interest for this payment method:

- staggering over time,

- the possibility of balancing your budget

- and to make ends meet.

- As far as the destination of the fractional payment is concerned, it is mostly used for the purchase of household appliances, high-tech devices and smartphones, furniture or travel.

- In France, 61% of users use it to make online purchases for small amounts and short repayment periods. 35% use it for purchases over 800 euros; and 63% opt for repayment spread over 2 to 4 monthly payments.

- Another particularity of the French market lies in the level of trust: 53% of users adopted it from a brand or site they already knew and which provided them with a reputational guarantee, evoking a need for reassurance that is well known in the French market.

Issues

- Long-term growth: According to the Xerfi research institute, the fractional payment market should represent 25 billion euros in France and 250 billion dollars worldwide by 2025.

- The challenge of extending repayment periods: depending on the legislation in force in each country (in France, fractional payments without fees, which are not considered as credit, are limited to a period of 3 months), usage varies. For example, only 22% of split payment users in France spread their repayments over more than 7 monthly installments; this proportion rises to 54% in Germany and Italy, 49% in Spain and 40% in Portugal, where offers with longer repayments are available. Nevertheless, the extension of repayment periods is a strong expectation, particularly in France where the average amount of purchases concerned is also expected to increase in the coming months.

Prespectives

- The democratization of fractional payments continues apace, despite the risks and a still unclear regulatory environment. The revision of the European directive is expected in September 2022. It should address the following key points: the obligation to display a clear schedule of payments before taking out a loan, prior checking of customer accounts, credit checks and limits on real interest rates.

- In the meantime, offers such as the one from La Banque Postale with Django present themselves as trusted solutions to meet growing needs.