Split payment, a must have for merchants?

Split payment is a method of payment inspired by consumer credit, that appeared in the early 1900s in the United States. Its first use at the time was in the automotive industry, allowing customers to pay for their cars in installments. Nowadays, the explosion of e-commerce gives a second wind to the split payment, which, in this context of health crisis, is more and more used by consumers.

Technology and changing regulations make it easier to get back in the spotlight

The use of credit varies quite markedly from country to country. However, split payment has been a universal success for several years now. In France, its success is due, among other things, to the tightening of regulations introduced by the Lagarde law in 2010. The latter has made consumer credit subscription much more complex. Players have adapted to this by pushing for split payments of less than 90 days, often free of charge, which are not covered by the law.

In Europe in general, but also in the United States and Australia, it is the disaffection for credit cards and the development of e-commerce that has pushed consumers towards split payment. An alternative that is much less expensive for them and whose routes are generally very simple.

Once encumbered by the many credit cards that went along with the use of cash reserves, today’s consumers are benefiting from more convenient and less expensive solutions. Indeed, technological progress spares no field, and the advent of the smartphone as the ultimate multifunctional connected object has made technologies once reserved for large companies and industries available to all.

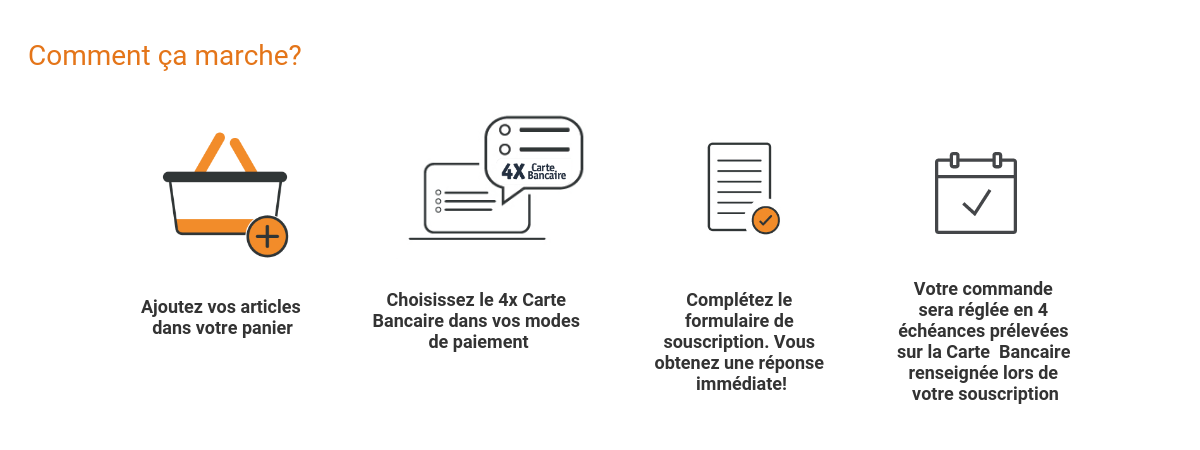

During his online shopping experience, the Internet user can benefit from payment in several splits from his home; and this with a simple click when finalizing his online order. Access to split payment is therefore frictionless and very discreet: the feeling of debt seems to be less strong this way rather than accumulating physical credit cards as it was initially the case. Moreover, many merchants choose to offer this functionality free of charge (three or four times free of charge), the cost being borne by a commission paid by the merchant.

It is therefore from this observation that many FinTech have left to offer this type of service to consumers. The Covid-19 crisis has created a sense of restraint for many people, depriving themselves of consuming out of fear of the future or financial necessity. Offering them more flexible solutions that allow them to delay payment reassures many of these consumers who were initially rather reluctant.

This phenomenon is primarily, but not exclusively, related to large purchases. This method of payment is designed for relatively expensive goods, from household appliances to cars. For example, a customer who wants to buy an appliance costing €1,000 can spread the payment of this amount over several months rather than having to pay the full amount when the good is purchased. However, since the beginning of the crisis, many players have noticed that these incentives are also often used to purchase everyday goods. A situation that worries European regulators.

A situation that is not without risks

Already briefly mentioned above, the advantages of split payment for consumers and businesses alike are real.

It allows for merchants :

- Increase the conversion rate of consumers’ online shopping paths. Because of its flexibility, paying in installments is less intimidating than paying in full.

- Increase the average basket of buyers, reassured by the possibility of paying for their purchases over the long term, and who tend to consume more.

- Avoid unpaid bills, which are paid directly by the lending partners.

For consumers, this split payment allows them to purchase a good immediately, even if their finances at time T do not allow them to do so, thanks to the spread of the bill.

The advantages of split payment are therefore undeniable and explain the phenomenal success it has enjoyed in recent months. So much so that European regulators are concerned about it. Indeed, they are aware of the possible abuses and flaws of this system, which could have serious consequences for some, especially fragile customers. Giving anyone, the possibility to freely take on debt, for large or small amounts, is indeed debatable and will require a framework for this means of payment.

The first regulator to have reacted is the British FCA, which has just published a guide to prepare the framework for Buy Now Pay Later (BNPL). The British authorities would like the players involved in split payment to be subject to the same rules as for the issuance of real consumer credit. This includes checking the borrower’s creditworthiness and identity, which could make the enrolment process more cumbersome.

And other countries could follow, notably France. Indeed, this activity requires supervision:

- to allow better information to the consumer, who must remain aware of the cost of this option when it is paid for (close to 2% of the transaction amount, equivalent to an annual rate of 8%)

- and to prevent the risk of over-indebtedness.

This method of payment is still widely used, especially in e-commerce. Its potential is very important because it is an option that remains much less expensive for the consumer than a traditional consumer credit. By dint of supervision and practice, the financial authorities and payment players should find ways to put in place safeguards to encourage its long-term use.