Payments players support the growth of the second-hand market

The second-hand market has undergone a profound transformation since the mid-2000s, a transformation made possible in particular by the advent of the Internet and e-commerce. In 2007, only 27% of French people said they bought second-hand goods online, compared to nearly 44% in 2016 and over 68% in 2019. As for the year 2020, it still marked a sharp increase following the health crisis. The phenomenon has accelerated with the multiplication of mobile applications and sites promoting this way of shopping.

Facilitating trade of second-hand between individuals

In any case, it is clear: the second-hand market and the sale between individuals have become a real way for consumers to find goods at a reduced price or to get rid of easily those they do not need anymore.

What explains this growing interest?

Several elements have made second-hand sales relevant and secure. The main obstacles to this type of exchange were and still are multiple: the anxiety present in some people concerning this type of trade concerns as much the less secure side of the payments as the fear of the condition of the exchanged products. It is indeed more “risky” to make a transaction with an unknown individual than to buy a new good in a store with a classic and supervised payment process. The challenge was therefore to make this sale between individuals more attractive and less frightening for the user. The user must be assured of the security of his transaction as well as having a minimum of after-sales service in case of disputes.

Some players have therefore looked at ways to democratize sales between individuals, based on digital elements and adapted paths.

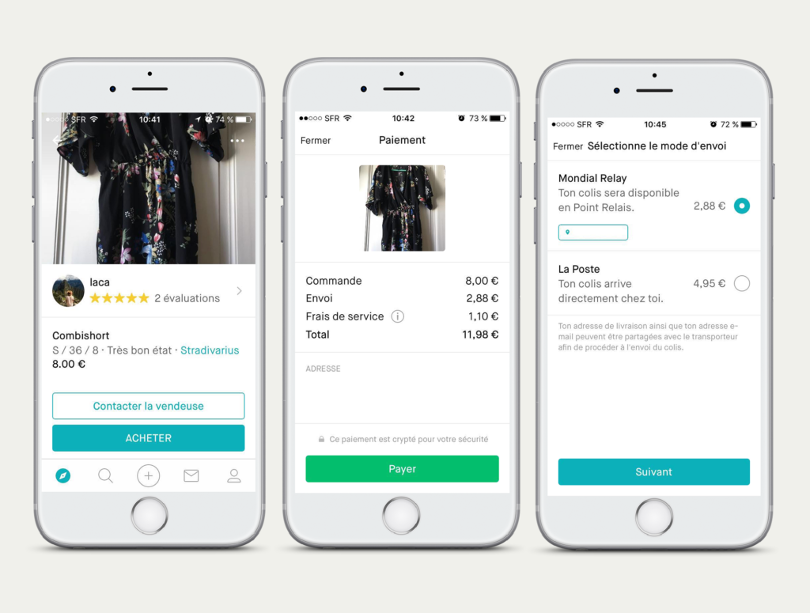

This is the case of Vinted, a mobile application initially specialized in the sale of clothes between individuals. The principle is simple: after downloading the application, all you have to do is take a picture of your product, attach a price to it and that’s it: it will be visible to potential buyers on the application. Once a buyer confirms his desire to buy a product, the purchase is managed by the platform; the seller will only have to send the product via Point Relais and wait for the reception by the customer. The customer will be debited only after the acknowledgement of receipt, Vinted taking care of the risks related to unpaid items via a “Wallet” dedicated to the application.

Leboncoin is another example of the success of the second-hand sales model between individuals, being one of the most visited e-commerce sites in France every year. The site has been a founding pillar of online private trade since 2006 and has been a major contributor to the democratization of private trade in France. Originally only physical, transactions between individuals can now be done online and more and more services are appearing on the site. It is thanks to this successful example that the trade between individuals has become a real business opportunity, proving to companies the interest of consumers on this kind of exchanges.

The challenge for the payment industry is now to regulate these transactions between individuals, both in terms of security and the payment methods and services offered.

For example, Cofidis has partnered with Tripartie, a start-up specialized in securing exchanges between individuals. Their goal is to deploy a payment solution in several installments in C to C, allowing users to pay for their second-hand purchases in installments. Transactions are verified in real time, and a dispute prevention and resolution section is provided to deal with any problems. 4 out of 10 French people would have recourse nowadays to the payment in several times to carry out their purchases, confirming the relevance of this kind of solutions of payment between private individuals.

Another example is Obvy, an escrow payment solution that has been developed to secure transactions between individuals; it recently signed an agreement with Floa Bank to offer its customers the possibility of paying in n instalments for their purchases between individuals.

Many start-ups and FinTechs are therefore beginning to think seriously about payment solutions that offer more security and flexibility to commerce between individuals. This means of commerce, relatively discreet at the beginning of the millennium, is now making a name for itself to the point of competing with Amazon and e-commerce more generally. Driven by digital platforms and new ways of securing transactions, B2C sales are no longer scary and are attracting consumers who want to buy goods at a reduced price while having the same payment methods available in a B-to-C transaction. There is still progress to be made on the handling of disputes and on ways to improve the service, but it is undeniable that selling between private individuals has become more commonplace.