The future of PISP and Pay-By-Bank in Europe

The PISP journey based on Open Banking

Fintechs that have started in the early days of account aggregation have set the stage for an upsurge of companies registering as PISPs (Payment Initiation Service Provider).

Prior to the 2018 Second Payment Service Directive (PSD2), account aggregators relied on web scraping as Banks preciously guarded customer data. The advent of Open Banking has since provided different inroads for account aggregators, formally known as AISPs (Account Initiation Service Providers). Through the use of open APIs, third-party developers may now build applications and services around financial institutions. Unsurprisingly, the roadmaps of AISPs have quickly morphed into additional services, notably Payment Initiations Services (PIS).

Although account aggregators were for obvious reasons quick to jump on the PISP bandwagon, actors including neobanks and telecoms have also sought registration.

PISPs in the payment ecosystem

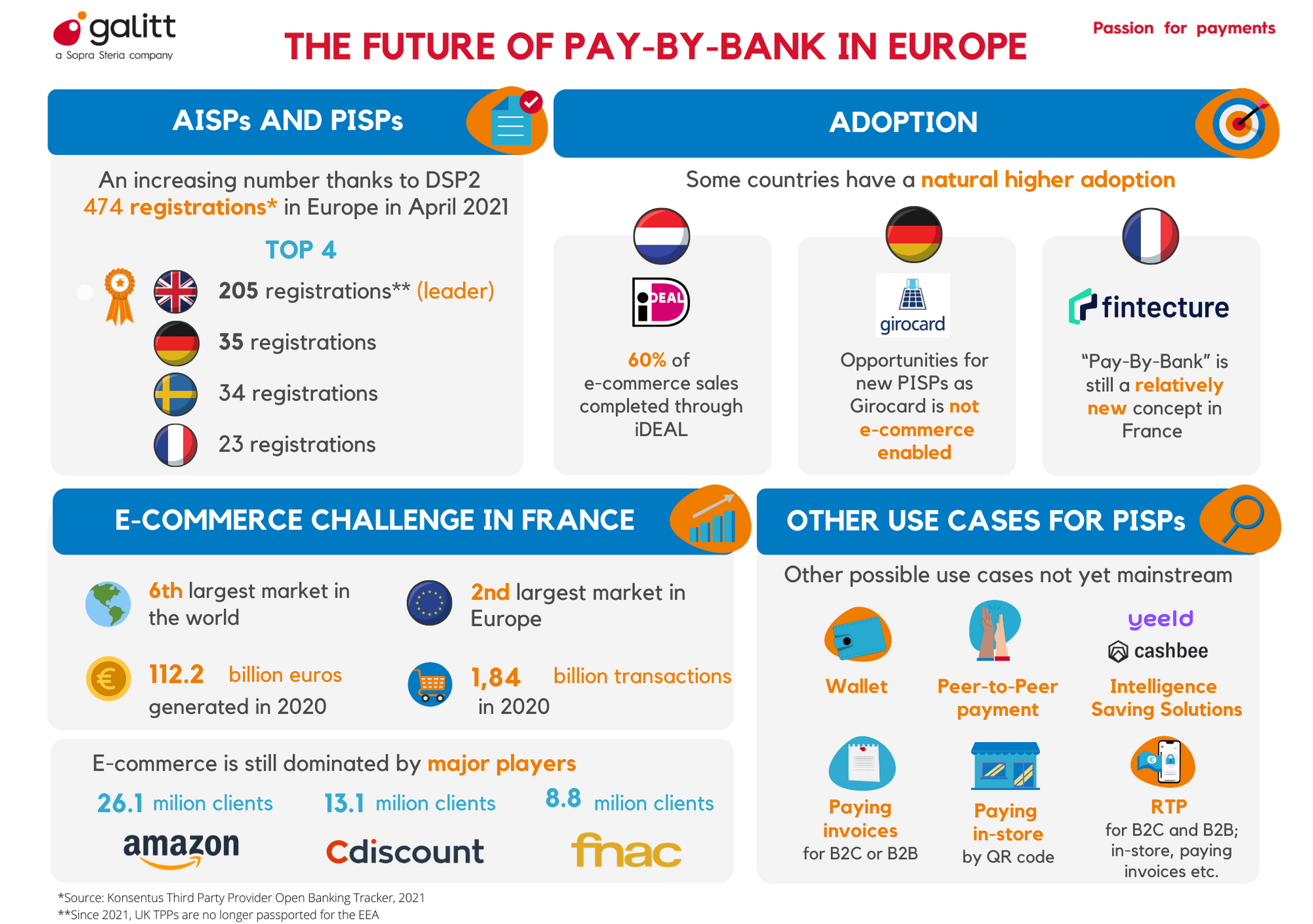

At the end of 2020, there were 450 Third Party Providers (TPP) approved across the European Economic Area and U.K., representing an increase of over 87% from the previous year. Of these TPP, over 50% are registered both as AISP & PISP. Only 6% of TPP register as standalone PISPs. This momentum has continued into the first quarter of 2021, with some slowing as result of the transition period of Brexit.

The U.K. has led the pack, registering 249 TPPs as of the first quarter of 2021 that can provide services in the U.K. (they are no longer able to passport their services across the EEA). Germany and France have 113 and 98 TPPs respectively and that are passported, and therefore able to provide cross-border services across member states. Other E.U. member states such as the Netherlands, Italy, Spain and Belgium hover around the same number of TPPs as Germany and France, also with the majority of TPPs being passported.

The PISP Pay-By-Bank Use Case challenge

Despite clear growth in open banking services by TPPs, and namely PISPs, use cases and adoption across the E.U. are not homogenous. Current use cases are found mostly in the e-commerce realm with Pay-by-Bank options at checkout. While account aggregation use cases may be easier to define and target, payment initiation poses much different challenges.

The first challenge concerns the customer journey, which can vary significantly between the solutions currently marketed by PISPs across the E.U. Through these solutions, the shopper typically clicks on a Pay-by-Bank button rather than using a bankcard. The shopper is then directed to their banking environment where personal bank credentials are entered securely and the transaction is approved. Additional steps in the process vary greatly, such as:

- A phone number to be entered as part of a verification process ;

- An additional authentication layer such a passcode via SMS ;

- Personalized messages to accompany the payment ;

- Detection of the bank application on the phone and launch it directly instead of having to search for one’s bank.

In the end, each of these measures adds complexity, leading to a payment process that does not necessarily have fewer steps than paying with a payment card.

Secondly, even with an optimized customer journey, the value proposition for the consumer must be compelling when it comes to changing payment habits. In the case of Pay-by-Bank, successful adoption means either solving a consumer pain point or leveraging an existing consumer habit. In Germany, for instance, the domestic debit card Girocrard is not e-commerce enabled, making it a ripe terrain for PISPs. In the Netherlands, nearly 60% of e-commerce sales are completed with iDeal, the country’s predominant bank transfer-based payment method, while just 16% are completed by card payment. Consequently, consumers are already greatly accustomed to buying on the internet through direct online transfers from their bank account with SEPA as the underlying infrastructure.

On the other spectrum, in France cards remain an important means of payment with 80% of online purchases done by payment card and less than 1% by bank transfer. France clearly has a stronger affinity to its payment card, and when it comes to developing a value proposition for Pay-by-Bank, the payment card is a fierce competitor. PISPs have to overcome several obstacles such as no card-like embedded insurance that payment cards offer, or chargebacks in the case of merchant-consumer disputes. Big-ticket items are a common use case for PISPs since card limits can be easily reached and a Pay-By-Bank solution resolves this pain point. However, installment payments have gained in popularity in recent years, especially for big-ticket items. Although developing an installment payment feature could be technically feasible for a Pay-by-Bank solution, it is not generalized today and therefore it adds to the competitive terrain.

Finally, PISP tout a value proposition for merchants mainly around security and lower costs. As transfers are irrevocable and funds are guaranteed to be available, merchants benefit from fast payments and less risk of chargebacks. Disputes between merchants and consumer can still happen, but the onus is on the consumer to try to resolve it with the merchant or raise a formal dispute with his/her bank. In general, transaction costs compared to card payments are lower, which can be very enticing for a merchant. These savings, however, may need to be shared with the consumer in terms of discounts in order boost customer adoption, shifting the generalization of this payment method to the merchant.

E-Commerce: Hope or Hype for PISPs?

E-commerce is experiencing phenomenal growth, especially in the last year as a result of the pandemic. In France, e-commerce sales have been growing steadily, placing France 6th in the world and 2nd in the European e-commerce market. The average online transaction in 2020 was 61 euros (vs. 59 euros in 2019), driven by the increase in average baskets for food, clothing, beauty etc. In France, 9 out of 10 internet users have already purchased a product or service online. Among these purchasers, the under 35 and over 65 age categories have seen the strongest growth in the number of buyers.

E-commerce certainly seems like ripe terrain for innovative payment solutions, however, the marketshare of the biggest Marketplaces is substantial. In France, there were over 200K e-commerce sites in 2020, however big players such as Amazon, Cdiscount and Fnac dominate the marketplace and 95% of total e-commerce revenues are generated by only 5.5% of merchant sites. In the Netherlands, where usage of bank transfers for e-commerce is already high, Dutch companies dominate the marketplace since big players such as Amazon initially invested more in markets such as France, Spain, and Germany.

Compelling Use Cases for PISP

E-commerce tends to be the use case most looked at by PISPs currently. Depending on the country, this may or may not be ripe terrain. Largely unexplored are other compelling use cases such as Request to Pay, Invoicing for B2B or B2C, or intelligent savings.

Request to Pay (RTP) allows the payee (for example a merchant) to send a secure payment request message to a payer (for example a consumer). It essentially opens a dialogue between the two parties, opening up the possibility to “push” a compelling value proposition for the payee giving them a greater range of payment choice, such as paying in installments or allowing the payee to ask for more time. Riding on the rails of instant payments, the merchant can also benefit from faster and secure collection at a lower cost compared to card payments. This model is also not limited to e-commerce, however, and could easily be imagined in-store for example.

Retail is just one playing field. Invoicing is another compelling use case, which can touch any industry, notably B2B models. There are substantial opportunities to develop a more secure and streamlined billing and payment solution with overlay services such as in reconciliation and digitized workflows. Finally, intelligent savings solutions, which aim to streamline and automate savings, are gaining traction, making it an interesting market to explore for PISPs