Can Payment be a vehicle for environmental responsibility?

The issue of global warming and the environmental changes that the world has been experiencing for several decades now is one of the most important topics of this generation. Studies showing the impact of Man on the planet are published regularly, with increasingly alarming findings. In this context, many actors are thinking about “green” and ecological solutions, which also affect the payment world.

Calculate the carbon footprint of your purchases

Payment companies have implemented measures that demonstrate their willingness to offer environmentally friendly solutions. This has become a common factor in the vast majority of companies, as consumers expect this type of measure.

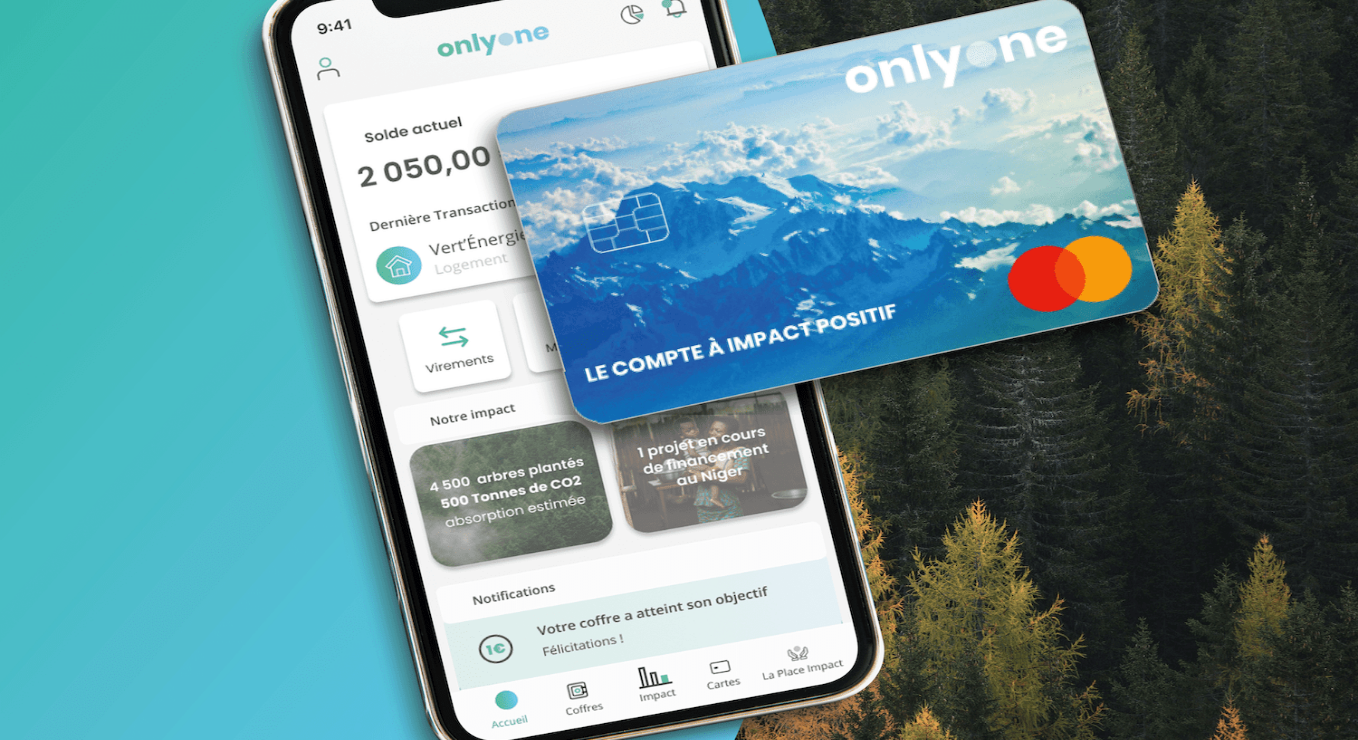

One of the approaches, developed by some Fintechs such as Doconomy or the association of Greenly and Onlyone, is to raise awareness among their customers by offering them ways to analyze the carbon impact of their purchases. In other words, these companies have developed a tool capable of assigning to an expense a certain coefficient that will allow the expense to be translated into kg of CO2.

Thanks to the data of the ADEME (Agency for Energy Transition), each of your purchases will generate a calculation of its environmental footprint, depending on the sector of activity of the company and the category of the purchase in question. The objective is obviously to make users aware of the often unsuspected impact of their daily expenses, while offering a more ecological alternative.

Source : Greenly

Recycled and eco-friendly payment cards

One of the most used payment tools in the world is the bank card, originally made of non-recyclable plastic. Distributed by millions around the world, some people even have several, it was relevant to find a way to make these cards eco-responsible.

Companies such as Thales and American Express (in association with the environmental NGO Parley) have therefore decided to offer bank cards made of environmentally friendly materials. The principle is simple: design cards with green materials. They propose a card made of poly lactic acid obtained from non-food corn, or a card made of PET from recycled plastic.

This simple principle is in line with the efforts of other industries, which are trying to replace some of their polluting materials with more environmentally friendly ones. Adidas, for example, offers a full range of shoes made from this type of recycled plastic. The ultimate goal for all these companies would be to use only this kind of green and eco-responsible materials.

Source : Rewardexpert

The initiative of some neo-banks

Neo-banks, which mainly target the younger generation and seek to differentiate themselves from their traditional counterparts, are doing so by positioning themselves in this niche of social responsibility.

A number of fintech companies are making sustainability one of their core values, even if it is not part of their primary product. Aspiration is a sustainability-focused neobank that promises its customers to plant a tree for every debit card transaction its customers make when they round up to the next dollar. To date, they have planted over 3.5 million trees. The company also donates 10% of its revenue to charity in the United States. They are certainly not alone. The Lendit conference featured a number of other socially conscious companies, including Ad-In Ventures, Climate First Bank, Meniga, Sunlight Financial and Stripe Climate.

CanB is a French fintech that has set up a “Giveback” system, allowing users to receive a small percentage of their spending to be added to a fund. They can then distribute the available funds to the associations of their choice. The principle is extremely simple to use and allows any user to participate in a virtuous cycle where a percentage of their spending will benefit associations, all at no extra cost to them.

Helios, on the other hand, is a neo-bank that assures its users that the money they deposit will serve the environmental cause. Helios insists on the lack of transparency related to the use of the money deposited in the bank. Indeed, once deposited, this money can be used to finance projects that are not necessarily eco-responsible. Helios is therefore committed to ensuring that every euro deposited in its accounts has an impact and promotes the ecological transition.

Finally, Paygreen is a “positive impact” online payment solution. It has set up two tools: “Online Rounding” which allows the merchant to recover capital from a purchase and share it with an association that he has chosen. The second tool developed by Paygreen follows the principles mentioned in the first part of this article: called “Tree”, it allows to calculate the carbon impact of an online sale. At the end of the purchase process, a contribution can be made to an eco-responsible project.

Better information for better consumption

Upstream of the payment, the receipt can be a vector for consumer brands to better inform the consumer, in this case directly in the purchase process. Carrefour, for example, is experimenting with the Eco-score, a label on their e-commerce site that assigns an environmental “score” to the products offered there. This Eco-score has been calculated by a group of independents focusing on the information of the products of the mass distribution (Yuka being probably the most known example). The goal is to be as transparent as possible with consumers on what they buy, by having a visual on the ecological impact of their spending.

The Färmoscope is a similar example of this system applied in Belgium, which on the basis of 11 criteria determines an indicator of product sustainability. Set up by the cooperative of organic stores Färm, it shares the same objective as the Eco-score: to make the purchases in stores as transparent as possible. The labeling of products in Färm stores has been completely modified in order to display the relevant information revealed by the Färmoscope: the origin of the product, its sustainability indicator (better when it is high), its label,…”

The common objective of these solutions is to make consumers aware of the impact of their purchases, while putting in place concrete ways to donate money to “green” projects. One might think that this sector of activity is far removed from environmental concerns, but this is not the case. Payment is an everyday activity that is repeated every day all over the planet with considerable frequency. As such, it must take its share of responsibility and find the means to respond to this global challenge.