The British Unicorn Checkout

After focusing on two B2C fintechs, today’s article focuses on a fintech targeting businesses. The British company Checkout offers cloud-based payment platform services. The fintech’s API allows users to offer their customers greater flexibility in the payment methods they can access.

How does it work?

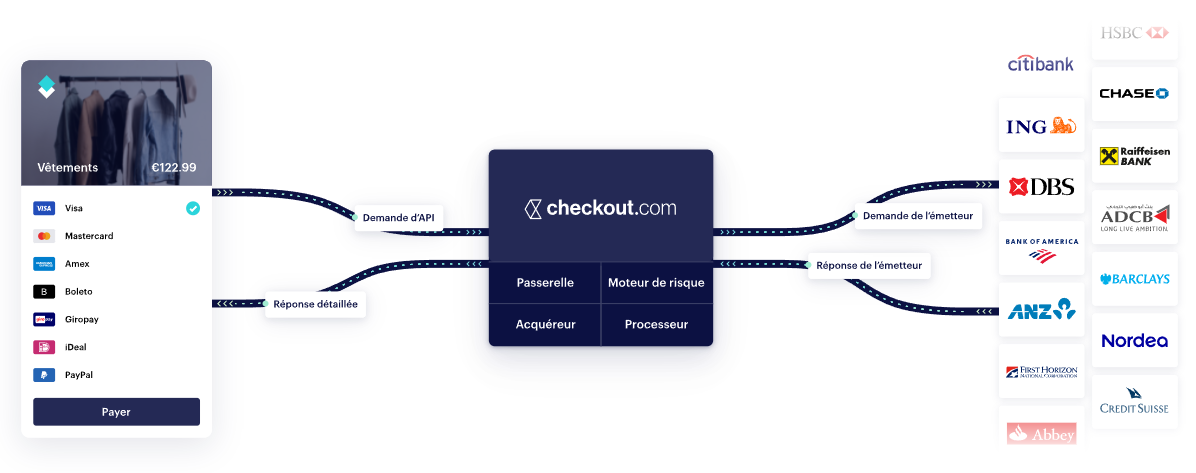

It is difficult to summarize Checkout’s proposition in two words. It is one of those Fintechs that have decided to bring their vision of an all-in-one platform allowing companies to easily manage their checkout and online payment tools.

It is essential for an online business to adapt to the digital medium. The competition is fierce and an Internet user will not hesitate to leave a merchant site for another one if the experience on the first site does not suit him. Checkout has understood this problem and wants to offer to e-merchants all possible tools to capture and retain the potential customer.

Checkout’s products address the entire payment process. Their platform covers the entire process, offering corporate customers a multitude of international payment methods while managing all other potential payments.

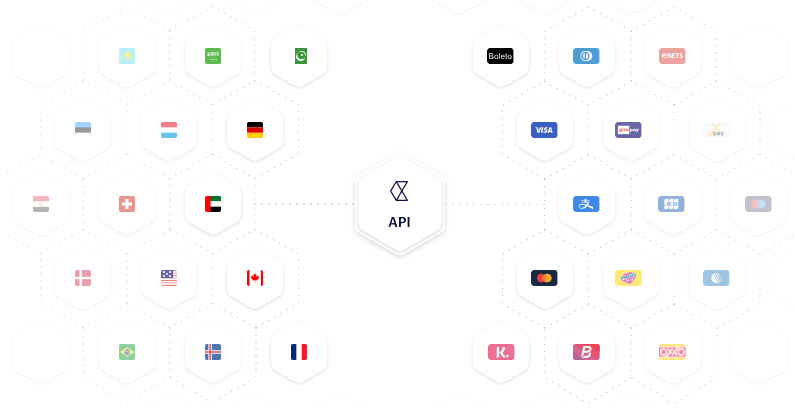

When a business uses Checkout’s services, it will be able to access these payments and remittance products. The Fintech’s API for payments allows a customer to pay with their own currency, even on a foreign site. A Japanese JCB cardholder will be able to pay for a purchase on an American website without any friction and without having to use a different payment method from his usual one.

The “Payouts” remittance service completes the British fintech’s offering. With a similar principle to the payment service mentioned above, Checkout’s infrastructure allows users to make transfers worldwide, covering almost all currencies. For example, a transfer initiated in Euros will be converted into the recipient’s currency, avoiding any additional conversion and greatly facilitating inter-currency exchanges.

These two services are the flagship features of the British company. It ensures a strict control of the fraud and a real follow-up, which convinced large groups to try Checkout. Swarovski, Winamax or Pizza Hut are among their customers, proving the reliability and efficiency of Checkout’s proposals.

History and fundraising

The rise of Checkout has been meteoric, driven by the growing interest in digital payment platforms.

After being officially approved as a payment institution in 2012, the fintech has continued to grow. Until 2017, it will have established important partnerships with payment players such as Visa, Mastercard, American Express or JCB. In just a few years, it will have succeeded in convincing these giants of the reliability of its system.

7 years after its official accreditation in 2019, Checkout will carry out its first fundraising and not the least: it is indeed 230 million dollars in European series A that will be raised to support the progression of the Fintech. In the process, it will have more than doubled its workforce, from 200 employees in 2018 to over 500 in 2019.

Checkout’s ascent is off and running. In 2020, the company will raise a second round of $150 million in Series B funding, bringing its employee count to 1,000 in 17 offices worldwide. In line with its rapid growth, the company will raise another round of funding in 2021, this time for $450 million. Checkout is then valued at $15 billion.

To sum up, Checkout has raised nearly $1 billion in just 3 years. These large amounts, all within a year of each other, are indicative of the UK platform’s resounding success around the world. The realization of this success came recently in 2022, with a last huge fundraising of 1 billion dollars, bringing the company’s valuation to 40 billion dollars!

To date, Checkout is no less than the third most highly valued fintech in the world, behind Stripe and Klarna. With a presence in 19 countries and 1,700 employees, Checkout continues to prove the appeal of frictionless, omnichannel digital payment platforms to businesses.