Lydia: the all-in-one payment application

Lydia is a French Fintech focused on one goal: to facilitate and promote mobile payments. Since 2013, Lydia has been expanding their offerings and providing more and more features on their successful app.

Lydia : How does it work?

Like many Fintechs, Lydia today covers a wide range of financial services, for both professionals and individuals. The differentiation between neo-banks and some Fintechs is sometimes complicated because the proposals of these two types of companies are so similar.

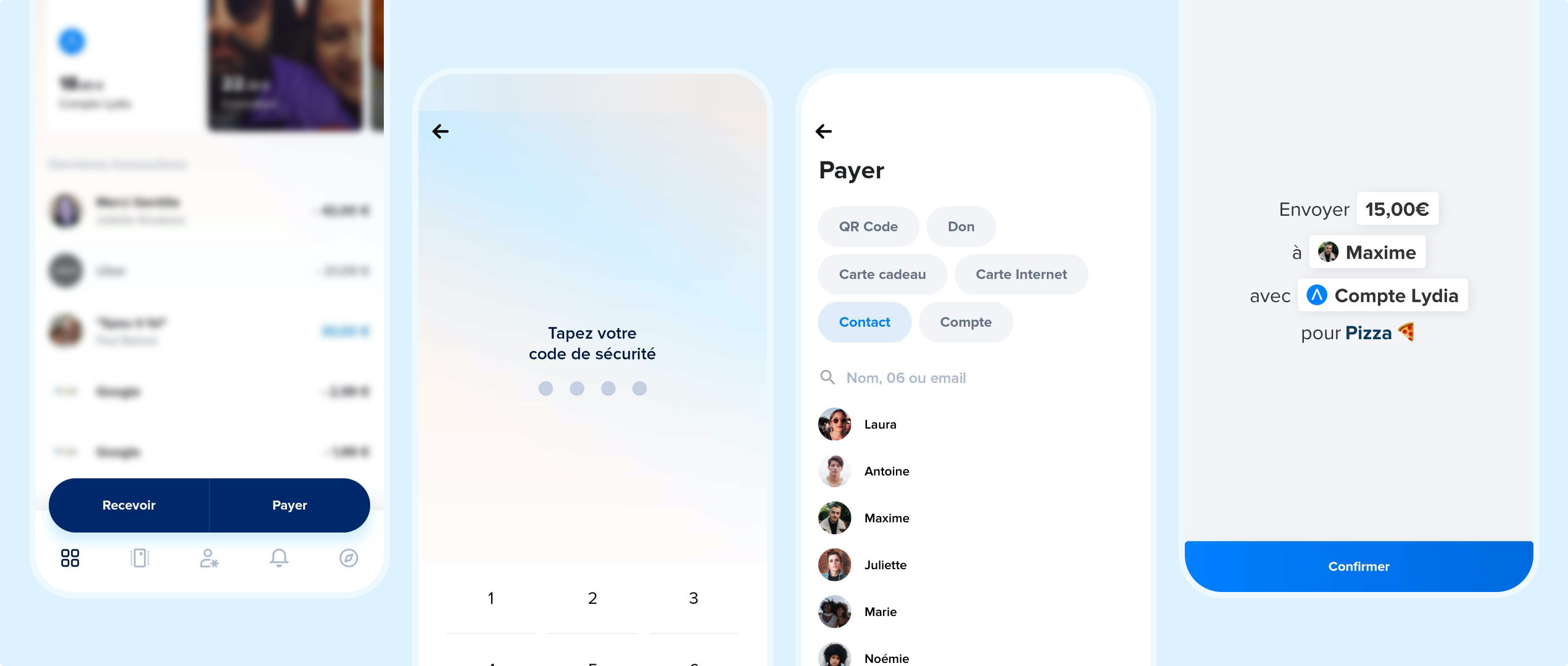

In the case of Lydia, the service that made the Fintech known and took off is that of money transfer between individuals, all requiring only a phone number. The way the service works is very simple:

- Download the Lydia application and create an account via your phone number.

- Register the credit card(s) you wish to link to Lydia.

- You are now ready to transfer money: select the recipient from your contacts or type in their phone number.

- Then enter the amount to be transferred and an optional note. The money is sent instantly to the recipient.

Please note: money transfer is only available between users of the application. A person who has not registered on Lydia will not be able to receive or send money via the fintech’s services.

It makes small transfers between individuals much easier. Instead of having to enter or scan the many digits of your friend’s IBAN, you can simply make a transfer in two clicks, as his phone number is probably stored in your smartphone contacts. If not, it’s still less time consuming to enter a phone number than the standard banking information required to make a transfer.

The service does not stop there and is constantly being expanded. For example, Lydia offers the possibility to create a kitty, allowing a beneficiary to claim a sum from different contacts for various projects: organizing a vacation, a common gift, etc. This is one of the trendy principles in the Fintech world, which we covered in more detail in our article Leetchi.

Finally, as mentioned above, Lydia is now more than a simple means of transferring money between individuals via smartphone. The fintech offers its own Visa card, and therefore a fortiori the opening of a current account attached to it. The service is advertised as frictionless with your current bank: you don’t need to change your bank to take advantage of Lydia’s current account since the two can be linked.

Fun fact: Lydia promises a refund for every 1,000 payments to a random user of the service, all with no limit on the amount. The Lydia account is of course secure to ensure smooth transactions.

7 fundraisings in less than 10 years

Launched in 2013, the French fintech has not stopped growing since its creation. In less than 10 years, it has raised no less than 7 funds, proving the attractiveness of its services.

The first of the list occurred shortly after the company’s creation, in September 2013. The €600,000 fundraising from Business Angels is the first building block of Lydia.

A little more than a year later, Lydia will raise 3.6 million euros from Xange and other Business Angels. Already a larger amount than the previous one, this round will continue to help the growth of the fintech.

We’ll have to wait until October 2016 for Lydia’s next round of funding. With an amount of €7 million, it confirms Lydia’s rise to prominence. The investors are more numerous here: we find the Duval group, Belcube, Newalpha Asset Management and others. Lydia is attracting more and more interest.

The French fintech’s fourth fundraising round will take place in February 2018 with the same investors as the previous one with a few exceptions. This time, it’s €13 million raised for Lydia’s growth.

2020 will be an important year for Lydia. At the beginning of January, Lydia will raise a new €40 million from investors. Among these investors, there is a big name of the Chinese BATX: the giant Tencent. Tencent will thus enter the capital of Lydia and strengthen the position of the fintech.

In this logic of progression, Lydia will raise another 72 million in December 2020 from its historical and more recent partners like Tencent. Lydia will thus have raised 112 million in just one year!

Finally, Lydia’s latest fundraising round further confirms the bright future of the fintech. In December 2021, Lydia is raising its last round of funding to date. With a total of 91 million euros from Tencent, Accel, Founders Future and others, it brings the total amount raised by Lydia since its creation to almost 230 million euros.

All these amounts will be enough to propel Lydia to the rank of French payment unicorn, its valuation exceeding $1 billion while remaining unlisted. Fueled by the digitalization of financial services, Lydia has the opportunity to thrive for a long time in the new financial world we live in.