Capchase, the Fintech that offers financial solutions to startups

Capchase is a New York-based fintech with an original proposition to say the least. Created in 2020 and therefore in the middle of the Covid period, Capchase has successfully launched and grown despite particular conditions. Let’s take a look at the success of this young Spanish-American Fintech.

What makes Capchase special

Capchase’s proposal is indeed very interesting for the startups that are increasingly flourishing around the world. Unlike the Fintechs we had the opportunity to deal with previously, its objective is not to compete with banks, neo-banks and in general traditional financial services.

Capchase has a different target: Startups. Aware of the problems that they may encounter, the Fintech offers them forecasting and anticipation solutions. Fundraising and financing in general are recurrent concerns when creating a startup. Often full of good ideas, they can often be slowed down by financing problems.

The idea of Capchase is therefore to give a more autonomous option to all these Startups in search of growth and capital, avoiding having to do a round of fundraising too quickly that will dilute the capital and the control of the Startup on its project. To date, Fintech offers three products:

Grow :

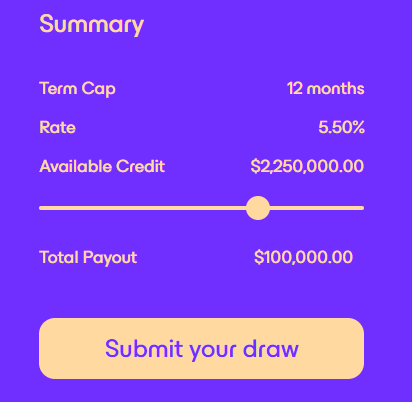

This option allows beneficiaries to access up to 60% of their Annual Recurring Revenue (ARR) once they subscribe to Grow. This option allows startups to access funds very quickly that would have taken them a long time to raise. The launch and the first years of a startup are important and decisive moments: unfortunately, many of them do not manage to pass this stage.

To benefit from Grow, a synchronization of the beneficiary’s data is required. Combined with the revenue forecast (ARR) mentioned above, Capchase will calculate the amount that can be allocated to the startup, up to one year of the initial growth capital.

Extend :

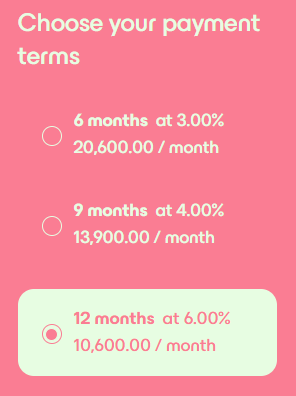

Capchase’s second product, Extend is a “deferred” payment option that allows startups to better manage when they pay various bills and expenses. They will be able to extend large expenses over a longer period of time, so as not to hinder their current activity. The principle finally joins another quite new financial product we talked about in a previous article: the Buy Now, Pay Later

Earn :

Finally, Capchase’s last flagship product is a way for investee startups to better monetize their “idle cash”, i.e. their unused and idle funds. In other words, EARN allows to maximize the profitability of the static funds of these Startups.

Two years of growth and success

In just two years and in the context of a global pandemic, Capchase has achieved a meteoric rise and has raised substantial amounts of money.

On January 12, 2020, Capchase is raising its first round of funding in the amount of $60 million from i80 Group. This will allow them to increase the amount of advance payments to their clients in their proposals.

Six months later, in June 2020, Capchase closed its second round of financing, this time for an estimated amount of $125 million (source TechCrunch). It is made with QED Investors, Bling Capital and ScifiVC.

It will only be a month before we see another round of funding from Capchase, and not the least: the Fintech will close a $280 million round in July 2020. This “round” is mainly due to the i80 group, which continues to attribute its confidence in the Spanish-American startup.

Finally, Capchase’s most recent fundraising to date will take place in March 2022. The $80 million round, led by 01 Advisors, confirms Capchase’s rapid growth in North America and Europe.

With more than 500 million dollars raised in two years and in Covid period, it is impossible to deny the attractiveness of Capchase’s proposals. Its new principle of support to startups in need is in the era of time and should continue to convince many of them.