Zenefits, the fintech that automates administrative and HR tasks

Zenefits is an American fintech that has chosen to address the diverse needs of corporate human resources. Targeting mainly small and medium-sized businesses, Zenefits offers a range of tools to facilitate the management of their employees’ payments as well as any other task related to human resources.

Zenefits’ 3 key services

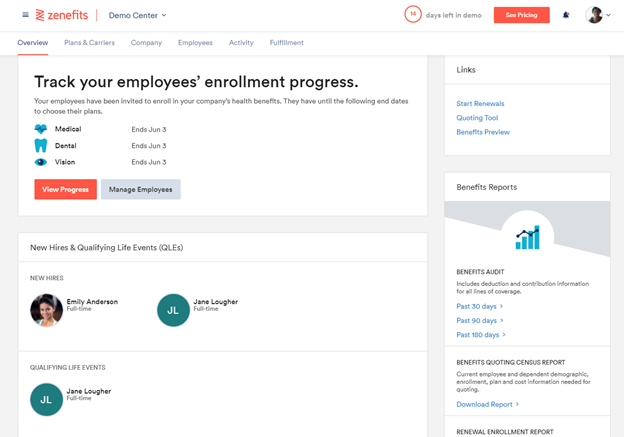

To sum up in a few words what Zenefits’ services provide, you have to visualize them as a giant dashboard full of features. The American fintech has divided these offerings into three main services.

The first of these is called HR (Human Resources) and offers the beneficiary companies a complete interface where they can enter, modify, add and delete information about their employees. This tool will allow to classify the company’s employees by job title, by seniority and other filters that will allow to easily find the desired employee.

The second important service of Zenefits is called Benefits and is this time oriented for the employees of the client companies. Still in the form of a digital interface, Benefits allows these employees to have access to a dashboard summarizing the different health plan offers available. Benefits will then allow HR managers of client companies to have a vision on what their employees have selected as a medical plan.

Last but not least, Payroll is Zenefits’ third flagship service. As the name suggests, Payroll is a comprehensive tool for automating payroll within a company. It includes a full range of services to optimize and simplify one of the most important tasks in the life of a company: payroll. From the management of service contracts to the auto-completion of taxes and other duties. Everything is designed to make payroll management accurate and simple.

Tumultuous history and major fundraising

Founded in 2013 in California, Zenefits quickly opened other offices in the US. In 2015, two will be opened in Arizona and Vancouver and another in Bangalore, India.

The history of Zenefits has been far from smooth. Full of ambitions and successes, the fintech will in 2016 be under various internal investigations. At that time in full expansion, having grown from 15 to 1600 employees quickly and made significant fundraising, Zenefits was under fire for accusations. These accusations were that Zenefits had taken advantage of the uncertainty surrounding the laws governing who can sell insurance in the US to boost its growth.

These accusations eventually forced founder Parker Conrad to leave the project and were replaced by David Sacks. David Sacks will work to “rebuild” the image and identity of Zenefits following the controversies mentioned above. For a year, he will lay off hundreds of employees and try to get Zenefits back on track, to be himself replaced in 2017 by the current CEO of the fintech Jay Fulcher. Zenefits is since February 15, 2022 owned by the TriNet Group.

Let’s quickly review the project’s funding. In 2014, Zenefits had already completed two fundraisings in six months, of $15 million in January and then, $67 million in June, respectively.

These raises were the beginnings of a huge investment in May 2015: with 18 investors, Zenefits will raise $500 million after only 2 years of existence. This incredible amount will obviously propel the Fintech to the rank of American unicorn with a valuation at the time of more than 4 billion dollars.

The Zenefits story is a roller-coaster ride from an initial phase of rapid growth to a major phase of rethinking. The fintech still exists and works, even if this questioning phase has inevitably slowed down its rise.