Primarybid offers to individuals access to corporate fundraising

Primarybid is a British fintech offering a digital platform allowing individuals to get involved in fundraising for listed companies. After a good start in the UK, Primarybid has launched its activity in France and intends to expand internationally.

How does it work?

The British fintech has separated its offerings according to user status: some aimed at retail investors, and others aimed at businesses willing to join the Primarybid platform.

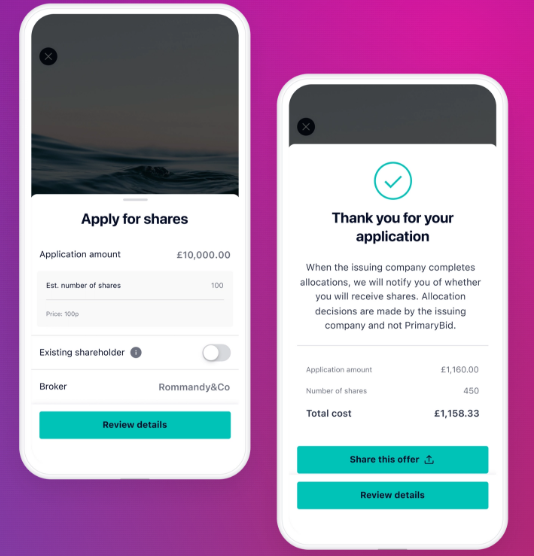

For individual investors, the procedure is very simple to follow:

- Create an account with Primarybid in a few moments, via the mobile app or directly on the fintech’s website.

- The investor will then be able to freely browse the different pages of offers available on the platform. They can activate specific notifications to be alerted of offers that may interest them.

- He will then have the opportunity to participate in these offers and apply for them directly on the application.

- Finally, Primarybid will take care of the payment of the shares to the investor once the auction is over.

For companies wishing to use Primarybid services, it will also be necessary to contact Primarybid beforehand. Once the registration procedure is completed, the company will be able to make its shares available to individuals for the duration of the offer in question.

The English fintech insists that releasing fundraising to individuals allows them to feel directly involved in the financing of a company. By participating in its financing, they will create a real sense of belonging and loyalty to the companies they have chosen to help. Primarybid also acts as a “link” between the two parties, even after the fundraising, by allowing them to communicate at any time on their platform.

Note: Primarybid focuses on accelerated placements, offers lasting only a few hours and offered at a discount.

Primarybid : News and implementation in France

Founded in 2015 and having quickly won over investors and businesses in the UK, Primarybid naturally thought about ways to offer its platform in other countries. Even if the legislation concerning Primarybid’s unique service differs from country to country, the fintech has in May 2021 succeeded in launching its platform in France.

In partnership with Euronext, Primarybid carried out in October of the same year the first fundraising including retail investors in France, for the benefit of the “cleantech” Ecoslops. Out of a total of €6.4 million raised by Ecoslops at the time of the partnership, €707,200 (11%) came from the financing of individual investors.

In December 2021, Primarybid will carry out its second operation in France with Global Bioenergies, which will raise €1 million via Primarybid’s service. In just a few weeks, the fintech will have successfully completed two operations in a brand new market.

It is important to note that Primarybid has had to adapt to French legislation and cannot for the moment offer its services directly on their own app, as is the case in the UK. The fintech offers its services through its three distribution partners: Bourse Direct, Boursorama and EasyBourse. We will have to wait and see if Primarybid’s solutions will eventually be made available to French users without going through these intermediaries.

Finally, the last big news to date for Primarybid concerns it directly: a fundraising but this time benefiting the fintech and not its customers. In February 2022, Primarybid raised 190 million pounds. This colossal sum reinforces the international desires of CEO Anand Sambasivan, who plans to set up offices in the United States after receiving the necessary authorizations in the country.

Primarybid thus continues its mission to make accessible to all, a practice historically dedicated to brokers and exchange agencies. The success of the fintech suggests a real interest for this kind of investment among individuals, curious to get involved in the financing of companies.