+Simple: The new generation of insurance for professionals

+Simple is a fintech specialized in insurance for professionals. In the same line as Alan, +Simple’s objective is to address the insurance needs of professionals, in particular the self-employed and very small businesses.

+Simple: Customized insurance

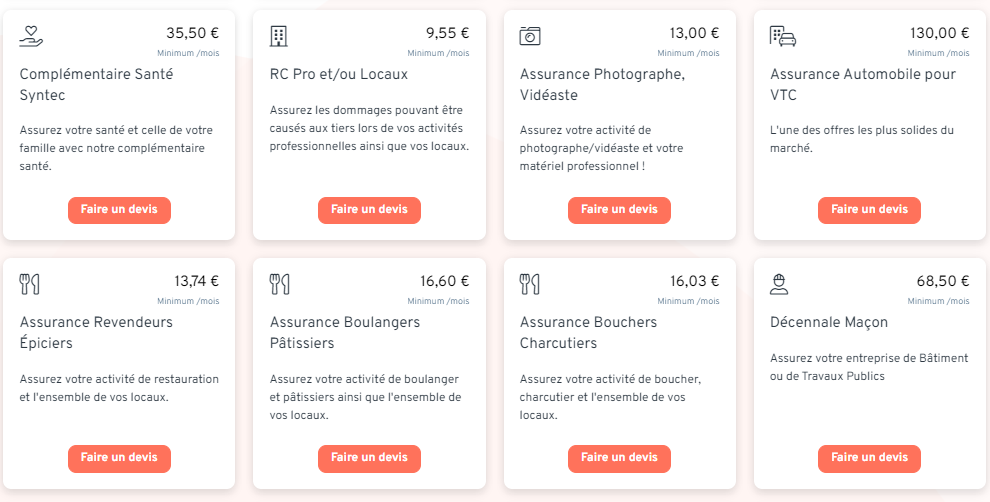

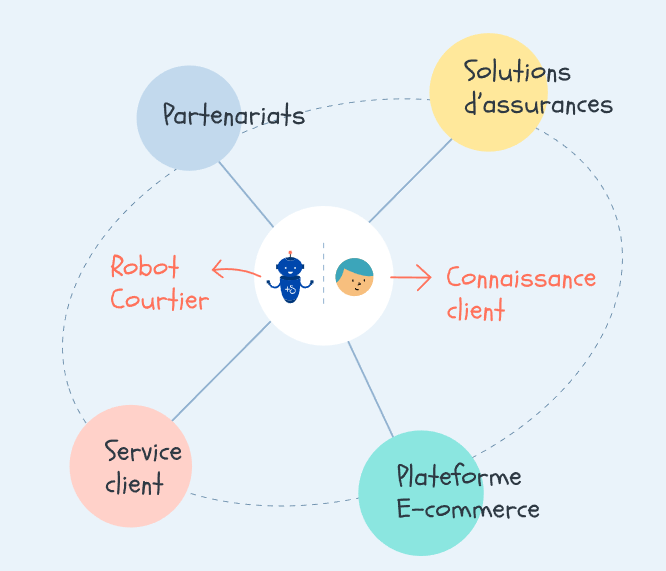

What strikes you immediately when you look at the services offered by +Simple is the diversity of the insurance offered. The French fintech really wanted to cover all independent professions looking for tailor-made insurance. To do so, it uses a robot-broker, which identifies the most suitable offers to make available.

There are insurances adapted to VTC, cabs, hairdressers, florists, photographers and videographers. More unusual insurances are also present among the proposals of +Simple. For example the civil liability insurance for tattoo artists and piercers, for yoga teachers or sophrologists.

To date, +Simple offers 37 different types of insurance, from general insurance to more specialized ones. The fintech has bet on a simple and sober site, allowing to quickly find the offer corresponding to the needs of the professionals, even when the one lacks information on how to insure himself.

The fintech also offers a training program, in association with PERITUS FORMATION, for people wishing to become brokers. +Simple even offers 3 different types of training: a face-to-face training in nearly 30 French cities, a virtual classroom with a trainer and a self-training via e-learning.

Access to the +Simple broker status is relatively simple: after creating an account, filling in personal information and the RCP (Professional Civil Liability) certificate, +Simple will analyze and validate the profile. The applicant will then benefit from a complete accompaniment aiming to help him in his steps.

Successive fund raising and international ambitions

In order to develop its robot-broker and more generally its activity, +Simple has raised several funds since its creation.

In 2017, two years after its creation, the Marseille-based fintech raised its first €800,000. Only one year later, a second round was raised for €10 million from the Rothschild family, Idinvest Partners and OneRagtime.

In 2020, +Simple continues to grow and raises 20 million euros, again from its historical investors Idinvest and Oneragtime. This fundraising is representative of a European, and even more widely international, fintech ambition. During this round, +Simple acquired April Enterprise Est and set out to conquer the German and Italian markets. The fintech already had 50,000 customers.

Before its next round, +Simple wants to build a new partnership with the leader of Banking as a Service Treezor. The objective is to facilitate the payment of brokers’ commissions while maintaining maximum security. This partnership reinforces the situation of the “Simplifiers” mentioned in the first part.

In March 2022, Assurtech (+Simple) raised more than 90 million euros from American investors and thus saw KKR enter its capital.

The future of +Simple lies in the internationalization of its activities. With these fundraisings and the confidence granted by its investors, there is no doubt that the simple and ergonomic platform will continue to convince the self-employed in need of personalized insurance.