Kuda, the Nigerian application for the bancarization of Africans

Kuda was born out of the frustration of its Nigerian founders, regarding the inconsistent banking fees and services they had access to. The African fintech therefore offers a full range of services aimed at educating and engaging its users on various banking tools.

Save, send and monitor your money

Like other fintechs we have written about before in this column, Kuda decided to compile some of the most used banking services within its app.

The first is simply access to a Kuda bank card, which the holder can acquire free of charge. Kuda even announces that it will not charge any maintenance fees, which must be paid every month. The card can be used to withdraw money from 3,000 compatible ATMs. The holder will have the possibility to block it directly in the application in case of loss or theft. The request to obtain the card is also done on the application: no need to go to a branch to access these services.

The second service offered by Kuda is money transfer. A bank account opened with the Nigerian fintech allows the user to make 25 transfers per month. And this is free of charge even if the beneficiary is not a client of the same bank as the originator. Kuda has set up a link transfer system allowing users to make all these transfers without communicating account numbers. The procedure is therefore faster while remaining secure, as the links expire after 24 hours.

Savings is the third main service offered by the fintech. With its “Spend+Save” tool, Kuda allows its users to set a savings percentage on each of the expenses made via the app. They will also be able to choose the frequency of these savings, from daily to monthly.

Finally, Kuda offers its users a complete management platform, providing a clear and instantaneous view of their finances. They will be able to create categories of expenses (bills, shopping, entertainment…) and thus monitor their banking activities more easily.

Little bonus: Kuda has set up a short-term loan system. This is available to regular users of the application, at a rate of 0.3% interest per day. Note that this service is offered automatically by Kuda, and is not automatically available to new users for example.

History and news of Kuda

digital lending platform called “Kudimoney”. After a few years of growth and testing, Kuda obtained a microfinance banking license from the Central Bank of Nigeria. With this license, Kuda will be able to dream bigger, with the ambition to become a serious alternative to traditional banks.

Since its inception, the fintech has operated from London, but initially set its sights on the African continent, starting with Nigeria. In the space of just two years, Kuda raised three rounds of financing, which were crucial to its progress.

Kuda’s first fundraising round at the end of 2020 was historic: with its $10 million round of financing, it was the largest initial fundraising on the African continent.

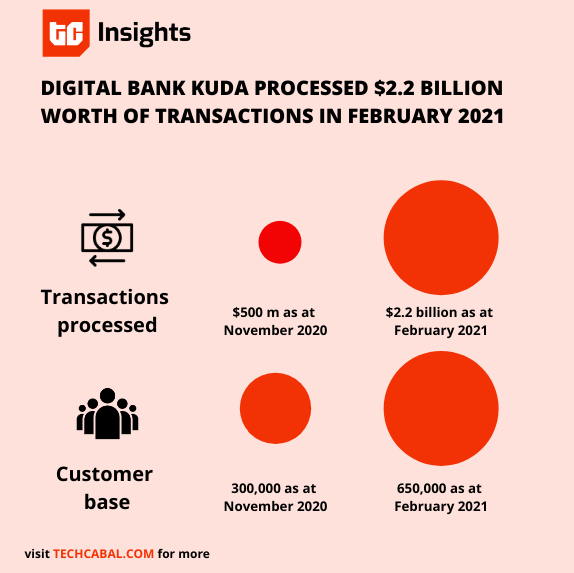

Four months later, Kuda continues its ascent by raising this time, 25 million dollars in Serie A. The main purpose of this raise is to support Kuda in managing the growing number of users on their platform and app. At the time of the first raise in 2020, Kuda announced that they had 300,000 users. This amount had more than doubled by the second round, with nearly 650,000 users by March 2021.

Finally, Kuda’s most recent raise was in August 2021, for $55 million and bringing the fintech’s valuation to $500 million. Again, it comes as the fintech was registering more and more users. At the time of this latest round, Kuda had 1.6 million users (compared to 650,000 in March 2021).

Now confident about its future, Kuda will be able to use this money to offer new services but specially to start its expansion on the African territory. The fintech is currently targeting the Ghana and Uganda markets. Its infrastructure (website and application) is being developed to accommodate these potential new customers. After having further consolidated its position in Africa, the fintech does not hide its desire to conquer other continents, with the United Kingdom as its main target, where Kuda has its headquarters since its creation.