Pento aims to automate payroll management in companies

Pento has set itself a clear mission: to revolutionize the way payroll and wages are managed within a company. According to the fintech, this tedious yet essential process deserved a new vision, always with the objective of making the task easier for the human resources teams of each company.

Pento: How does it work?

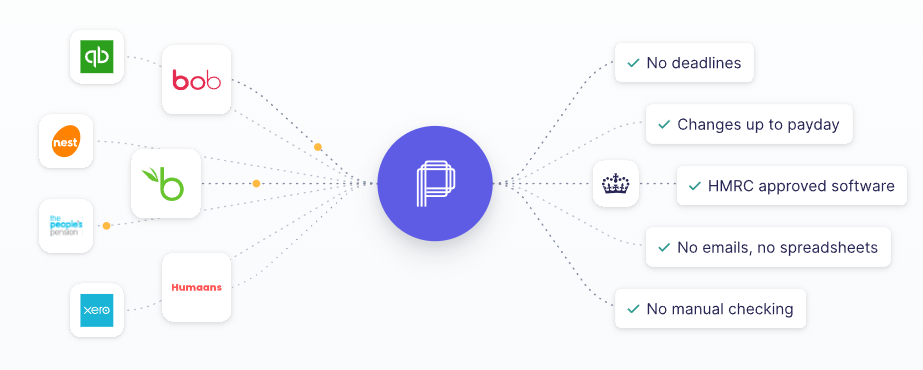

First of all, Pento had to think of a way to integrate its services into the already existing accounting and HR management tools. The British fintech therefore partnered with some HR platforms such as Xero or QuickBoosts.

This allows for a more gradual approach for companies wishing to use Pento’s tools, which will not have to change their operations completely but just be guided in integrating these tools into their accounting platforms.

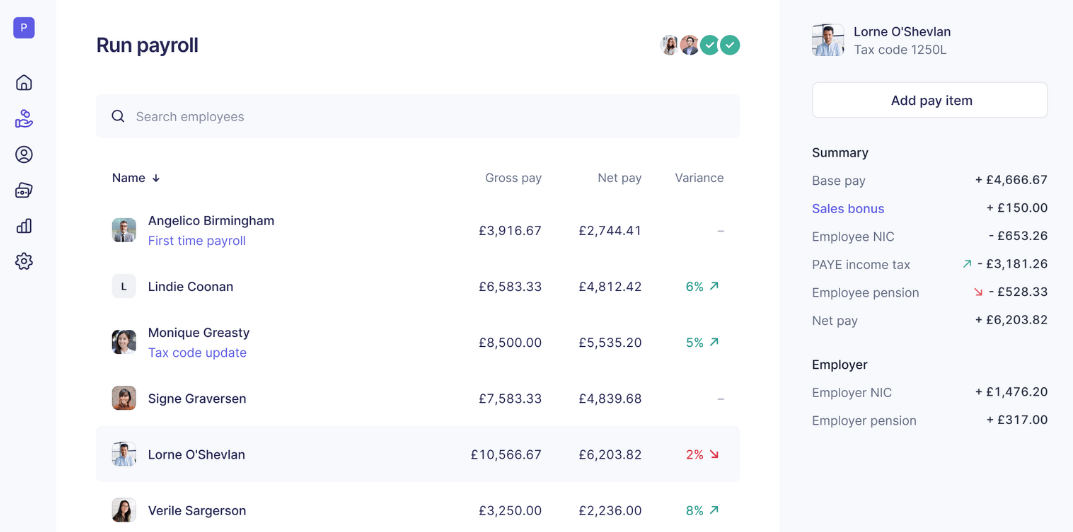

Once integrated, Pento’s service is divided into three simple steps:

- The user will be able to edit and modify remunerations up to the payday, to take into account even the most exceptional cases. Pento’s tool will automatically adjust earnings and contributions in real time. It also allows for the addition or deletion of employees from the database, the viewing of draft pay slips and the backdating of salaries.

- Once the first step is completed, the next step is a “review and approval” The HR teams in charge will be able to set up a simple approval flow system, with which they can collectively ensure the right amounts and more easily identify possible errors.

- Finally, the salaries are validated and Pento automatically takes care of the payments!

Like many of the fintechs we feature in this column, Pento places a strong emphasis on the ease of integration of its tools.

Aware of the fear of many companies to change their long implemented processes, it had to do everything to promise a complete fluidity for the transition to its services. Pento promises to synchronize its tools with existing databases, avoiding manual entry of all information during a transition to a new tool.

Two examples of successful integrations

Pleo :

Pleo is a British company, experiencing rapid growth since its inception in 2017. This growth has logically led to more and more hires, with Pleo seeing its number of employees grow rapidly.

She wanted to find a more efficient way than the available payroll tools, and turned to Pento’s proposals to solve three of her problems:

- Too much unnecessary communication: Pleo quickly realized that its teams had to exchange many emails in their HR process. Many of these emails were confirmation requests, continuous exchanges of documents… Overall, redundant and time-consuming actions.

- Long periods of frozen payroll: Pleo depended on a third party to calculate its employees’ payrolls. This third party needed information days before payday, often resulting in changes not being reflected and a lack of overall fluidity.

- This partnership with the above-mentioned third party did not prevent Pleo from still having too much manual work of entering and sending documents. The goal was to reduce this manual work as much as possible and to move towards completely digital tools.

The promise of full automation ultimately convinced the fintech to trust Pento. The tools offered by the latter were the only ones prepared to support Pleo’s rapid growth, which now relies on Pento since 2020.

Good Monday :

Good Monday is a Danish company offering a range of tools for office life, from cleaning services to the installation of plants, beverage stands and any other element that improves life in the workplace.

Accustomed to similar services as Pento in their home country, Good Monday was surprised not to find them more easily when they set up some of their teams in London.

After some research, the Danish fintech got wind of Pento’s services and didn’t hesitate to take an interest. Good Monday was able to import all the information of its employees now living in the UK, by connecting Plento’s services to HMRC (the UK government department responsible for tax collection, including Her Majesty’s Revenue and Costume) and to their pension provider.

Within days of Good Monday sending out its employee information, the entire process was in place for their payments. Pento also touts the “built for scale” aspect of its services, which take into account its clients’ desire to grow. Adding a new employee or deleting an old one is just a few clicks away in the British fintech’s tool.

Good Monday is therefore pleased to have found a partner like Pento, who was able to reassure the Danish fintech’s finance teams, who were worried about the transition to a new country with its share of new regulations and customs potentially different from those they knew.

Pento’s services are in direct line with the desire of companies to transition to a more modern administration and internal management that is less dependent on paper and human intervention. With automated tools, but still supervised by the human eye, the compromise offered by Pento seems to be adapted to a successful transition towards automation and digitalization of processes such as payroll management.