The role of payments in the future of mobility

The start of the new mobility era

Not since the first Model-T car rolled off the assembly line have we seen such a disruption in mobility. In countries such as France, Belgium and Finland, government regulations and investments in mobility are paving the way for new models. These new laws are to mobility as the PSD2 is to open banking, aiming to benefit consumers whilst boosting the startup ecosystem in Mobility as a Service (MaaS). On the one hand, traditional actors along the fuel value chain are facing regulations that are disrupting their models, and on the other hand new government incentives promoting alternative mobility are fueling a whole wave of innovative startups with disruptive solutions. Mobility consumers also play a role in the transformation, demanding better options and better experiences.

To what extent will payments be affected?

Payments has quite a unique role within the changing mobility ecosystem. What does this mean for the fuel card? Are private label cards a thing of the past? Will new solutions only favor open loop instead of closed loop? Will the payment card be the new transport ticket? Will the mobile be the new payment card?

The pace of change varies greatly within Europe. London, for instance adopted open-loop contactless payments in 2012 for its public transport network. Finland is known as a pioneer in mobility, placing emphasis on digital technology. It is also home to the mobility startup, Whim, founded in 2015 and today is a leader in mobility applications in Belgium, Austria, and the U.K.

Often payments adapt to society’s changing preferences through government regulations and laws. For example, Belgium has a strong company car culture, and in 2019 the government passed a Mobility Budget legislation. Among many initiatives, the law allows for a fiscally advantageous mobility package in order to incite employees use more green means of transportation. France passed a similar law in 2019 with the Mobility Law of Orientation..

A zoom on what changes with the law LOM in France

Enacted in 2019, the law LOM (Mobility Law of Orientation) aims to transform France’s transport policy so that it is better adapted to the needs and expectations of the population. It is based on 3 pillars.

- Facilitate the deployment of new solutions to enable everyone to get around

- Initiate the transition to cleaner mobility

- Investing more and better in daily transportation

One notable measure that companies are taking note of is the creation of a sustainable mobility package. With a benefit of up to €500/year (as of January 2021), the mobility package covers costs for alternative transportation for commuting to work, such as carpooling or by bike. Based on the principal of the meal tickets widely used in France, the measure aims to allow the payment of the package via a mobility voucher, or eventually a digital mobility card. It is particularly interesting for employers as it can be combined with the employer’s contribution to the public transport season ticket, and it is tax and social security contributions free.

Although these measures are relatively new in France, we can look to countries like Belgium or Finland, with more established Mobility as a Service (MaaS) models, which demonstrates a rich mobility ecosystem that melds the payment journey into a seamless experience.

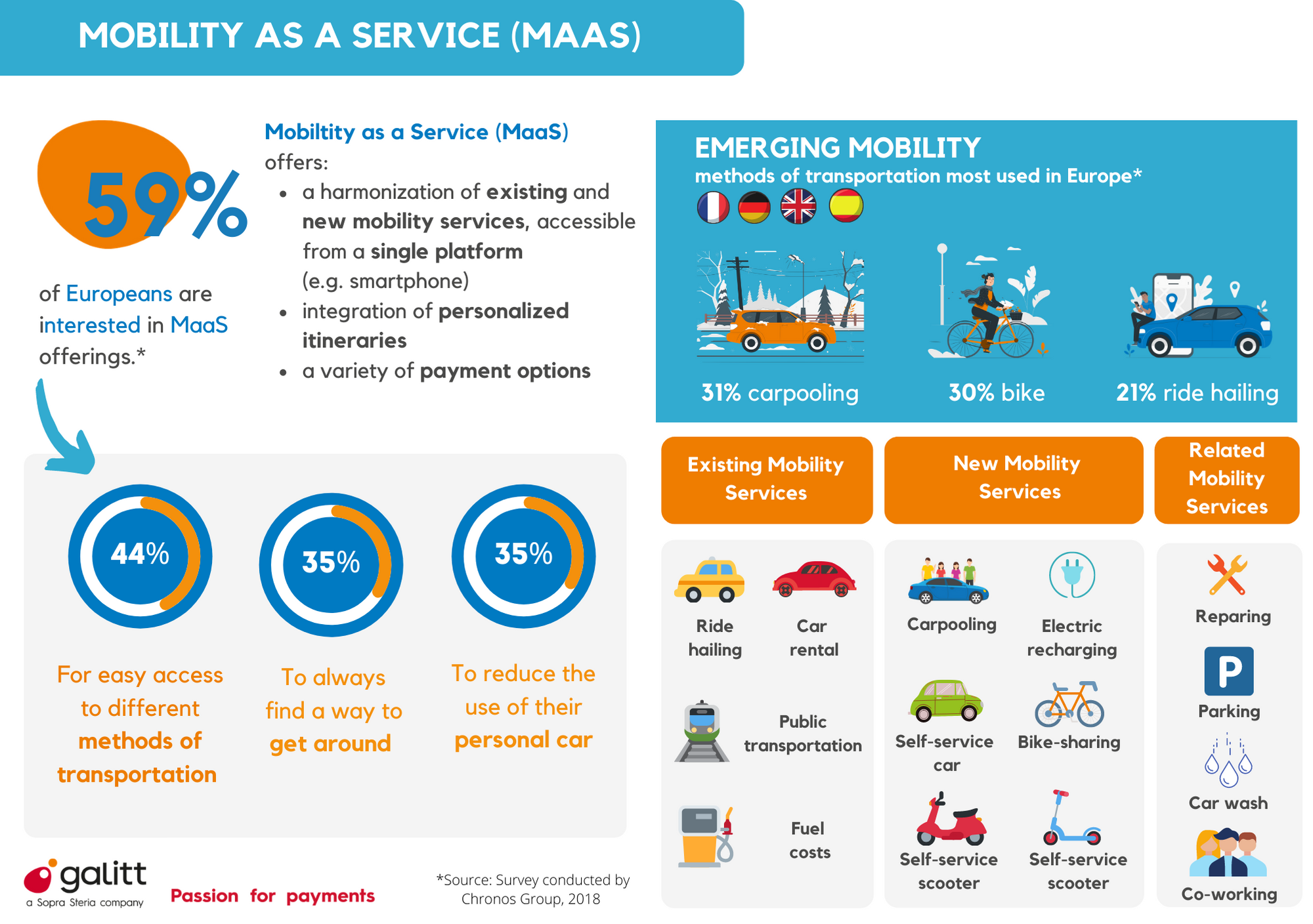

Mobility as a Service

A quick observation of the streets shows that people get around so much more differently than several years ago. Mobility as a Service, or MaaS, responds to this growing trend by offering travelers to use all modes of transportation, harmonizing existing and new mobility services.

Europe as a whole has seen an accelerated trend in the adoption of alternative mobility. As such, mobility startups/scale-ups are developing mobile-centric value propositions covering a wide range of use cases, from selecting the most efficient journey to securely and easily paying.

- Planning : choosing between different travels options, calculating the best route (fastest, cheapest, weather dependent, etc…).

- Executing : booking and storing tickets on a smartphone, which can then serves as a transport ticket

- Purchase : accessing a frictionless payment journey, whether via a wallet or a dynamic monthly subscription, which calculates the best pricing, based on what is actually used.

Concretely what this can look like is a user opens up an application and indicates a destination. A proposed itinerary is given, and since the weather is so nice, the app proposes to rent a bike for part of the journey and finishes in public transport the rest of the way. The user is directed to the nearest free-floating bike station, uses the smartphone to unlock the bike, and when the bike is returned, the user’s account is automatically charged for time used. Next, onto public transport where the user scans a QR code on the smartphone to access and pay for her ride.

Payments: paving the way for better consumer experience in transit

MaaS opens up both opportunities and challenges, as different actors in the ecosystem have to work together to make it a reality. Consumer’s expectations of the MaaS model is based on a one-stop-shop principle. This brings to the forefront the complexity of using various transport modes with different payment methods.

Solving this complexity relies on two critical elements. First is aggregating and integrating services into one digital platform. The go-to platform is generally the smartphone. Second is the right to access the payment data services of transport operators, which may not be a reality EU wide, but it is the case in certain countries such as France with the law LOM (2019) and Finland with the Finnish Transport Service Act (2017). These national laws also lay down provisions for the technical interoperability of ticketing systems by requiring all public transport providers to open their single or subscription ticket APIs for third-party resales. Consequently, this one-stop principle favors moving towards one device for everything, including the payment card.

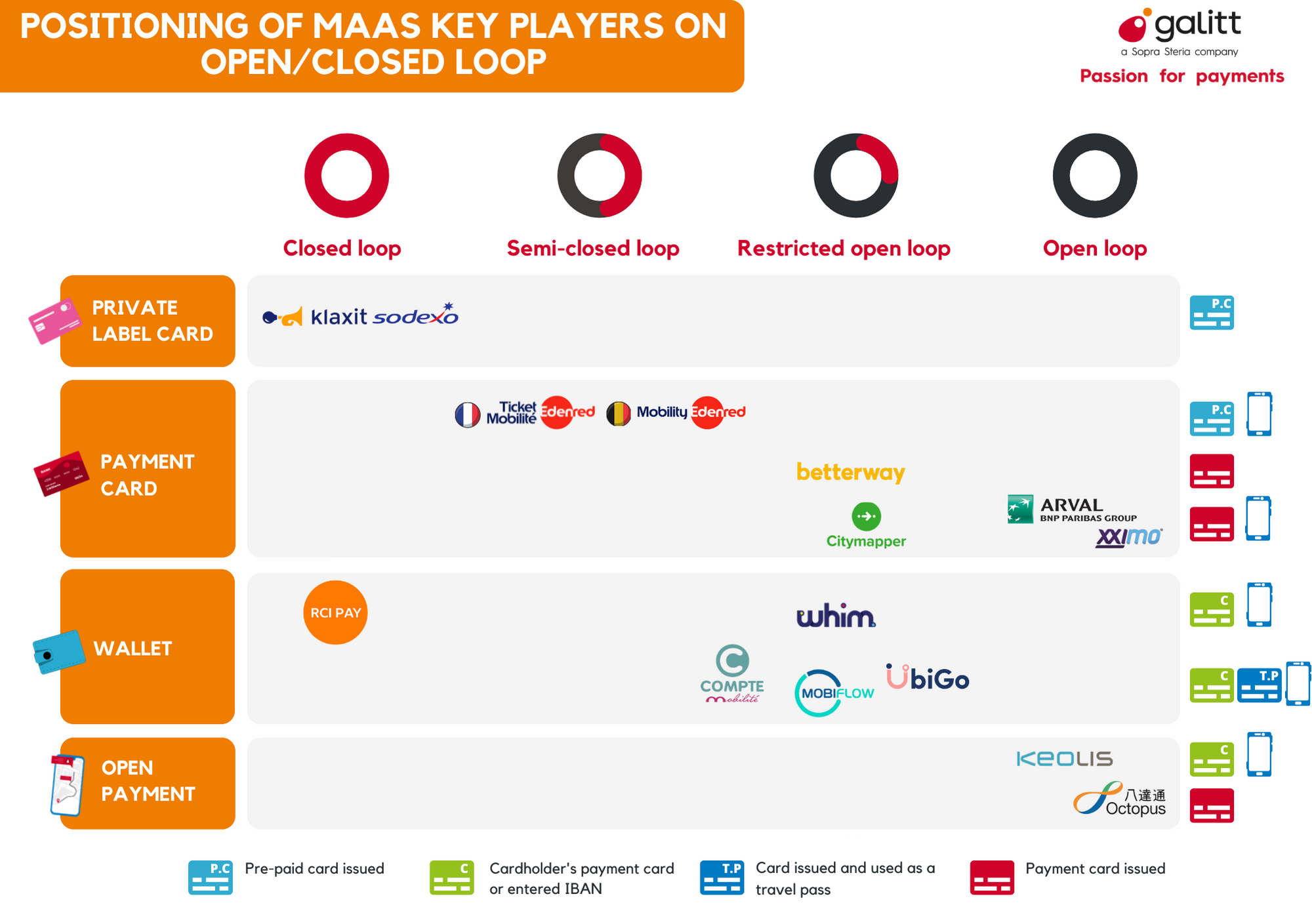

The payment approach within the MaaS model is quite dynamic, at times evolving within established paradigms such as closed loop private label cards, or taking new dimensions such as wallets and open payments.

Within a closed loop system, you have the advantage of leveraging a partner network and often the business model leans B2B, with solutions aimed at employers providing pre-paid cards to their employees for their mobility services. The disadvantage is that the network can be quite restrictive, offering a limited number of mobility services dependent on the partnerships established. The risk is not being able to keep up with the pace of the multitude of services a consumer actually needs or wants.

There is a growing trend towards restricted open loop models, which is where we tend to see mobility startups positioned. By limiting the network to a merchant category code, the mobility offer can more quickly scale. The business models today tends to be B2C, although this is just more a choice of market position because B2B models, although less prevalent, do exist.

How fast these payment models may converge is unknown, but what is clear is this domain is evolving at a rapid pace. On the one hand, the pandemic has sent millions of workers to work-at-home, but on the other hand, it has also accelerated alternative mobility trends, for instance, bicycle usage has jumped in 2020 by 27% in France and 44% in Belgium. Whatever MaaS models prevail, it is evident that payments cannot be separated from mobility, as it is a key element in making MaaS a success.

Want to know more about Galitt’s study on payments and mobility?