FintechOS helps banks and insurers in their digitalization

FintechOS is a Romanian fintech with a specific goal: to support traditional banks and insurers in their digital transition. Aware of the difficulties and obstacles encountered by some of these players, FintechOS offers a whole range of tools and digital APIs that are easy to integrate for beneficiaries.

FintechOs: A veritable arsenal of digital services

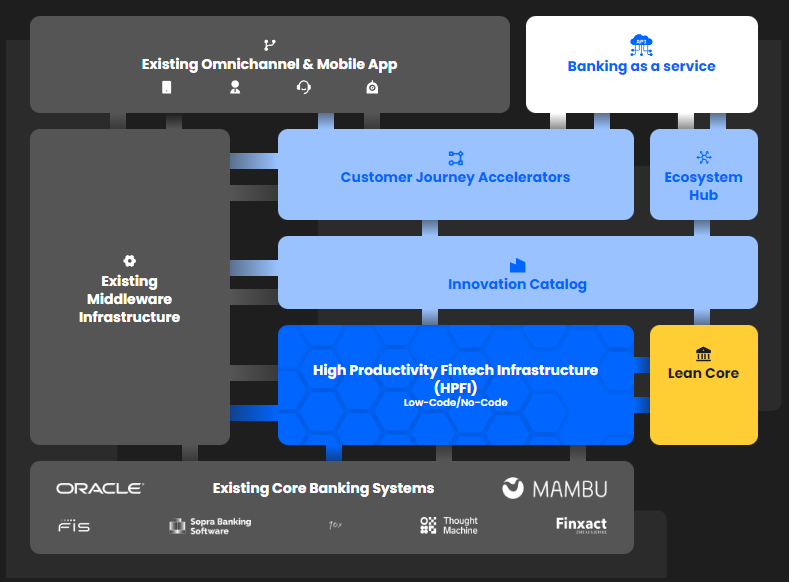

The Romanian fintech does indeed have all the right elements for digital support. FintechOS’ first pillar service is “Lighthouse”, its comprehensive digital banking transformation platform.

Lighthouse comes in the form of a fully customizable interface. The user will have control over the influence of the service, deciding how much of it he will integrate into his own tool. He will have the choice to fully use the Lighthouse interface or to select only certain blocks relevant to his business.

FintechOS emphasizes the easily integrated nature of Lighthouse, which will not require dedicated technical teams or dedicated developers. The service is the cornerstone for transitioning to fully digital propositions, especially for traditional banks that need to change their decades-old infrastructures.

On the insurance side, FintechOS also has a digital insurance platform. Named “Northstar”, it promises users a super-personalized insurance product experience. Northstar is basically the equivalent of Lighthouse but for insurance, allowing insurers to have complete tools to transition to the new digital market.

FintechOS is currently focusing on 4 different insurance products: life and health insurance, home insurance, veterinary insurance and small and medium-sized business insurance.

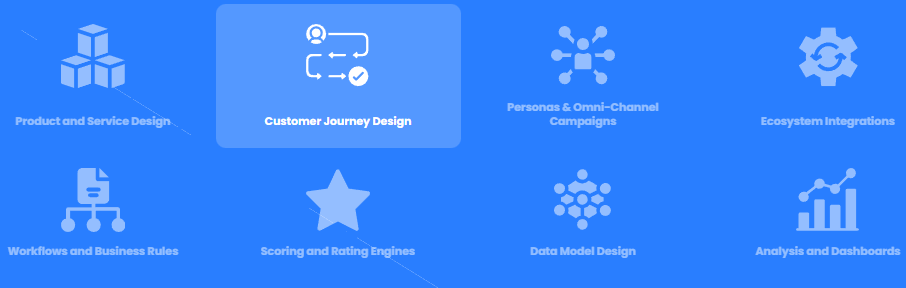

To further support its customers, FintechOS has created the “Innovation Studio”. This particular tool leaves room for the imagination and creativity of its users, offering them a space where they can build their own customer and product paths. As previously mentioned, FintechOS places particular importance on the accessibility of its services. These services must be easy to use for “non-technical” people and employees, allowing for example sales people to use them without having to ask for help from more technical developers or positions.

Finally, FintechOS has its own marketplace full of APIs and tools that can be integrated. For example, there is a Buy Now Pay Later plugin, which promises a BNPL product launch in just 3 months. A mortgage calculator is also available, quickly determining what the applicant can aspire to and how much the loan will cost. Many other financial plugins are available on this marketplace offered by FintechOS.

Major banks already won over

Founded in 2018, FintechOS has been steadily building its business over time. With an initial fundraising of $14 million in 2019 and another $60 million in 2021, FintechOS has more recently set out to conquer the U.S. market with major partnerships such as the one with Microsoft, Deloitte and Capgemini.

Among its most important customers are some of the largest European banks such as Société Générale. The French bank, like many others, has seen the importance of going digital to capture new customers and to change the way its products are offered. The director of digital transformation at Societe Generale, Maja Mikic, explained that she has two specific objectives for this transformation.

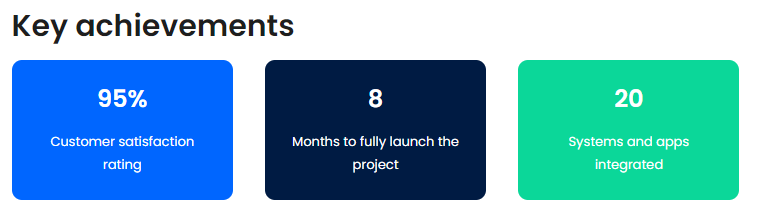

The first was to change the way customers interact with the bank. Even if physical visits to the branch are still possible, it is no longer the main vector as it used to be. People are now using digital, and Société Générale called on FintechOS to build a completely digital interface with the best possible customer experience.

The second objective of Société Générale was to revolutionize the way it manages its internal administration. It called on FintechOS to change the way it works by reducing wasted time and optimizing the collection of information. This was done by automating processes that were once long and tedious, but are now fast and ergonomic.

Integrated in eight months, the project has been a success and Société Générale believes it has successfully completed its initial transition. For example, the new processes have enabled the bank to offer access to loans in as little as 15 minutes, drastically reducing the time previously required, which was considered one of the biggest obstacles to completing the transaction.

We have focused on the case of Société Générale, but FintechOS has also won over other players. Vodafone, Oney, Vienna Insurance Group or Erste have trusted FintechOS for its ability to accompany them towards more digital solutions. Any business nowadays must have a digital ambition to continue to exist, even the big banks dominating the financial market for a long time.