Pennylane and its accounting management tool

Pennylane is a French fintech that has developed a complete tool to facilitate the accounting process within companies. This tool is made for freelancers, VSEs or SMEs wishing to save time on their accounting to focus on their core business.

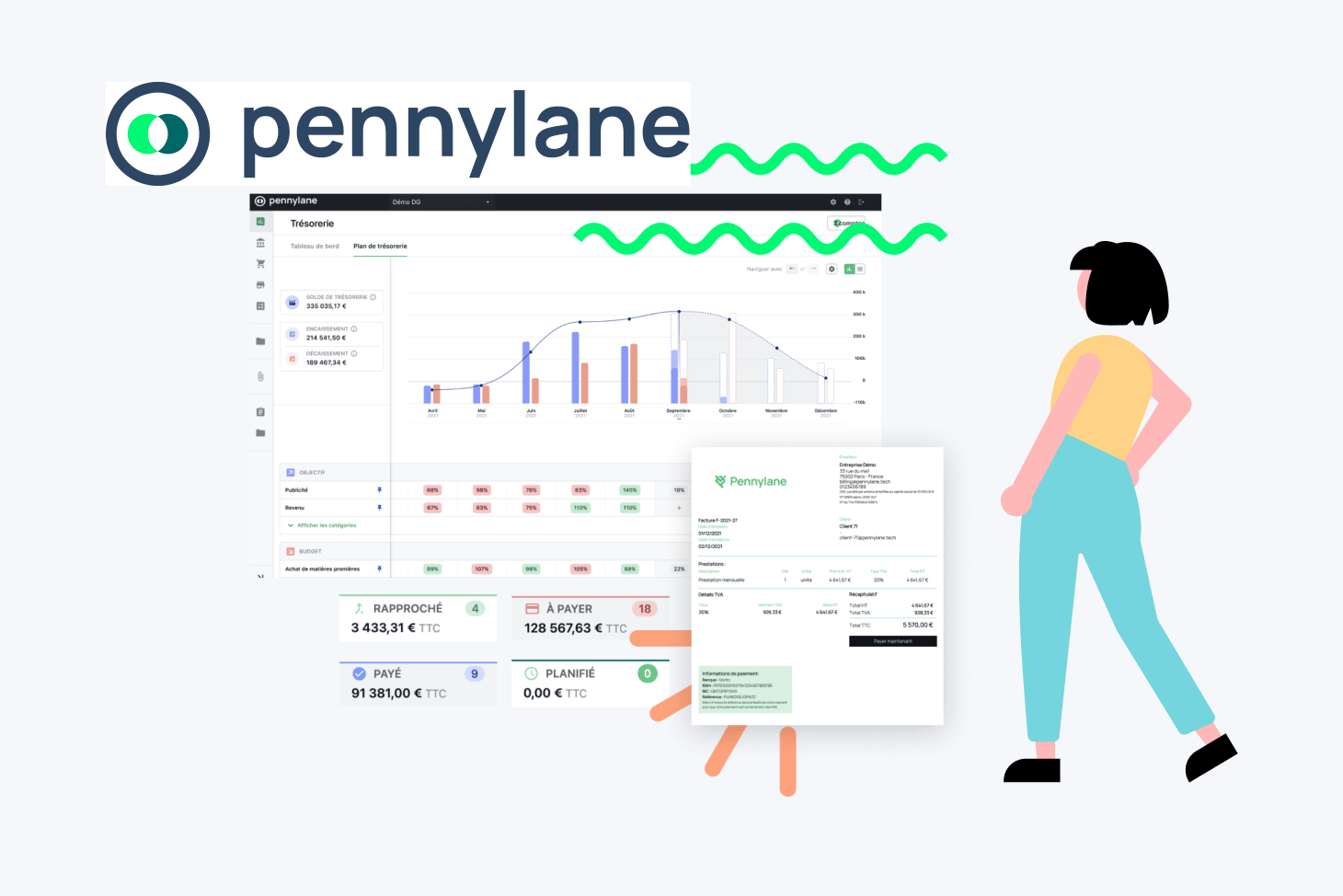

Pennylane : All-in-one software

Pennylane’s tool therefore covers all the important elements to consider when managing a company’s finances. One of the primary features of the software is the ability to create quotes and invoices in the blink of an eye.

Users will be able to edit these estimates and convert them into invoices with a single click via the dedicated mobile application. The functionality even takes into account subscription billing and will update the invoice in case of variation in amount or period.

Once these invoices, purchase orders and others are created, the software will be able to centralize them and automate their payment. The company will be able to import its invoices into Pennylane’s tool, which will automatically pay them.

Recurring and monthly invoices from a supplier will be taken care of and the beneficiary company will not have to manually deal with each invoice every month. It will also be able to set the payment method it wishes to use for each supplier, from bank transfer to credit card payment.

With all the data retrieved during the above-mentioned steps, Pennylane will be able to optimize the follow-up of its customers’ cash flow. They will be able to synchronize all their bank accounts to the fintech tool and have a vision on the invoices to be paid.

Pennylane promises its customers a fully automated cash flow statement that is updated in real time, eliminating the need to manually create and manage a more traditional Excel document. The client’s expenses will be categorized, giving the user a clearer view of their expenses.

Major clients after only 2 years of existence

Founded in 2020, Pennylane is still in the early stages of its history, but that hasn’t stopped it from capturing the attention of already successful fintechs and clients.

This is the case with the well-known app Yuka, which has nearly 20 million users in 11 countries. Their barcode scanning tool “measures” the health impact of scanned products and has become a hit in a short time.

Like many companies experiencing rapid growth, Yuka was looking for solutions to optimize their time management, especially for tasks considered “low value-added” such as accounting or administration.

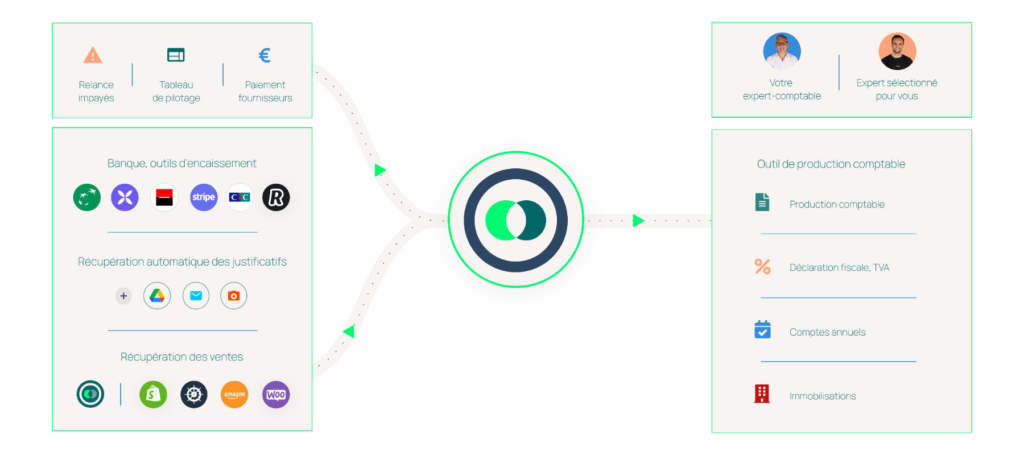

Pennylane’s solution interested them mainly because of the possibility to centralize expenses from different tools. Yuka uses many products from different companies: Stripe for the management of flows or Qonto for the banking aspect, to name a few.

Pennylane’s software has allowed Yuka’s teams to avoid wasting time on retrieving and communicating information from each tool they use.

Dating app Happn has also been a major customer of Pennylane since January 2021. More than 120 million people use the app, which processes nearly 200 supplier invoices per month.

There is no need to prove the interest of a management tool in this case, which quickly interested Happn being as for the case of Yuka in full growth phase. Here again, Pennylane’s ability to handle several tools (Qonto, Stripe) immediately caught the attention of Happn’s teams.

The centralization of bank flows has also allowed the accounting teams of the dating application to avoid consulting each account individually and then make calculations on the overall cash flow. They will be able to have a direct vision on this cash flow thanks to the Pennylane software, while automating the data entry and making the creation of the numerous reports made by Happn more fluid.

The French fintech is therefore able to capture the attention of companies in a growth phase and in need of clarity on their accounting. This tedious and yet essential exercise for the proper functioning of a company can be a source of concern if it is not managed properly. Pennylane brings security and allows its customers to focus on their real business without wasting precious time on automated and time-consuming tasks.