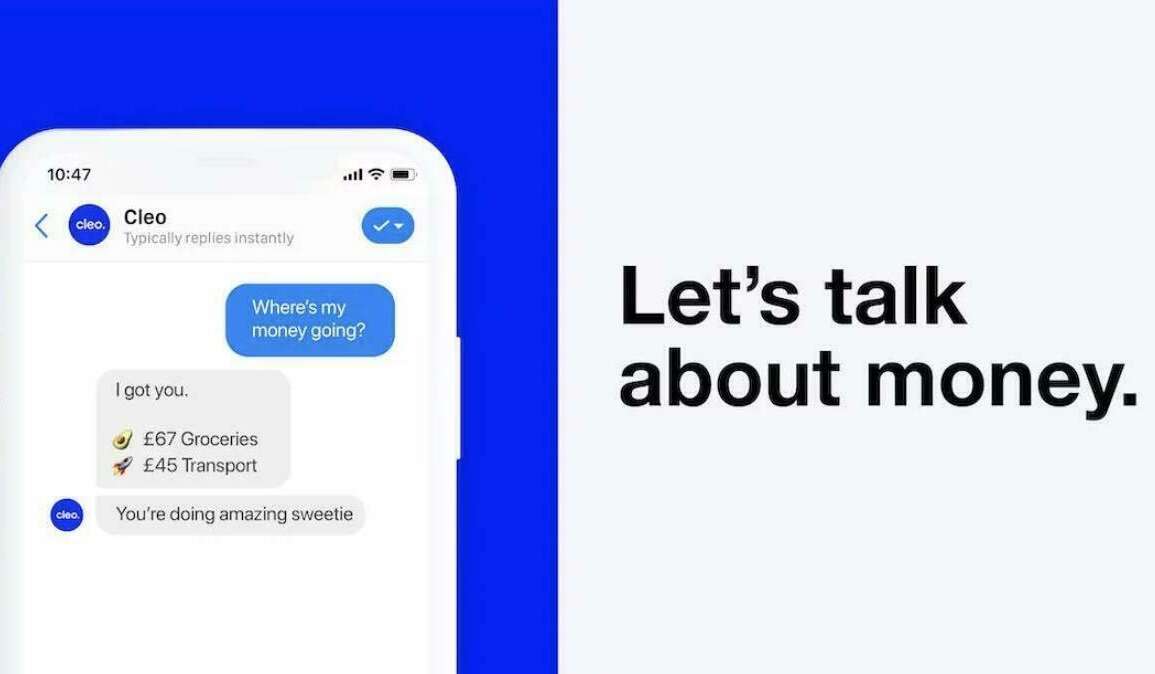

Cleo, AI to monitor the finances of new generations

Cleo is a British fintech that has developed an artificial intelligence to manage personal finances. With its sharp and direct communication, Cleo’s main target is the new generations interested in the various contemporary financial services.

The different services of Cleo

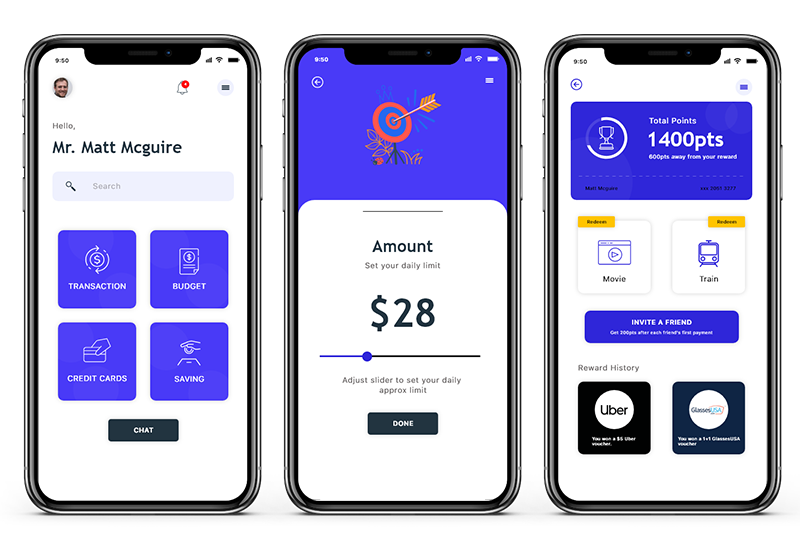

Like almost all fintechs and startups these days, Cleo works mostly through a mobile application, in our case free of charge. In order to fully benefit from all of the fintech’s services, users must link their bank account(s) directly to this application.

Cleo focused on 4 popular and well-known financial services. Let’s remember that the target audience here is indeed Generation Z, and Cleo has decided to focus on the most understandable services without going into a too vast and complex panoply. Many neo-banks and fintechs, some of which we have discussed in this section, already offer more complex solutions, and this is not Cleo’s target market.

On the other hand, the British fintech ensures a simple and instinctive use regarding the 4 main services it offers:

- Setting up a budget: Cleo’s artificial intelligence advises the user in real time on the best ways to set up and manage a budget. It takes into account variances in income and expenses to assist the user on a daily basis. The AI analyzes the last 3 months of expenses and then proposes a customized budget.

- Save money: the fintech gives its users access to different ways to save money. They will have the option to set a goal, which the AI will help them achieve by automatically saving money.

- Borrowing money: Cleo has set up a way to support its users up to $100, if they qualify. Early adopters will generally be eligible for a loan of between $20 and $70, which in the future can go up to $100 if they pay it back in good standing.

- The “Credit Builder”: Cleo offers a targeted service for countries where the credit score is used by banks and financial institutions to grant loans to consumers. We had seen this principle in a previous article and Cleo accompanies its users in improving this score.

The fintech’s services are therefore deliberately simple to access and use. Cleo does not claim to cover all financial services, even the most complex ones. Its goal is to reach the part of the population that is new to finance, to offer them very simple and colorful tools to make managing their finances more fun.

Note: a paid service at $6 per month is also available, offering cashback, salary advances and a credit score coach.

Succession of fundraising

Improving an artificial intelligence system is not without costs, not to mention the ambitions to conquer other markets. In the space of 5 years, Cleo has raised 5 main funds to develop its tools.

In 2017, a first round of €600,000 will be raised from Business Angels. In the same year, an additional 2 million pounds will be raised to support Cleo’s growth. A year later in 2018, an additional $10 million will allow Cleo to target markets other than the UK.

At the end of 2020, Cleo will expand by raising $44 million to strengthen its AI and expand its teams. Finally, in June 2022, the fintech will raise its last round of funding, in the amount of $80 million.

These amounts will allow Cleo to consolidate its position in the United States, which will become their main market. The simplicity of the services offered by the fintech has convinced investors and users alike to trust Cleo’s tools. With the multitude of tips and guides available both on the application and on their blog, the fintech is well on its way to continuing to support its users over time.